Intel Could Win All of Apple's Modem Orders This Year

Chip giant Intel (NASDAQ: INTC) entered the cellular modem business in 2011 with the acquisition of Infineon's wireless division. Since then, Intel has poured a lot of resources into that business with the aim of transforming it from a technology laggard into a leader.

This business scored its first big win under Intel's wing in the second half of 2016, when Apple (NASDAQ: AAPL) chose to use Intel's XMM 7360 LTE modem to provide the cellular capabilities for a portion of its iPhone 7-series devices. Intel, yet again, won a portion of the modem orders for the current iPhone 8-series and iPhone X device with its XMM 7480.

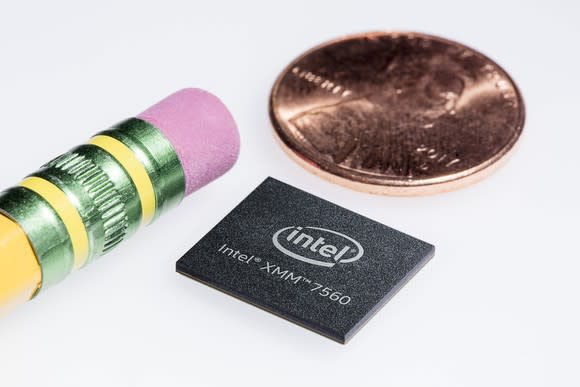

Image source: Intel.

Now, the XMM 7360 and XMM 7480 were missing a critical feature -- support for a wireless standard known as CDMA. This meant that iPhones based on Intel's modems wouldn't work on several major networks that used the standard, capping the share that Intel could gain in the iPhone.

However, Intel's latest XMM 7560 modem supports CDMA, which could allow the chip giant to, theoretically, win the entirety of Apple's modem orders for the coming iPhone product cycle. And, according to one analyst, that's exactly what's set to happen.

High yields, potential for 100% share

A previous report from Fast Company stated that "Apple is expecting Intel to supply 70% of the modem chips inside the new iPhone models," with Intel potentially getting all of the orders for the 2019 iPhones "if all goes well."

At the time of that report, Fast Company said that Intel was struggling with the yield rates -- that is, the percentage of the modems produced that ultimately turned out to be salable -- of the XMM 7560 chips.

"Only just more than half of the chips being produced are keepers," Fast Company said.

It seems that Intel worked through those yield issues after all. Analysts with Baird (via StreetInsider) claim that their "checks" revealed that yield rates on the XMM 7560 were "high" and that Intel could, in fact, win all of Apple's modem orders for the new iPhones in the second half of 2018.

Although the Fast Company report said that Intel was expecting to get 70% of the modem orders for the new iPhones this year, it did say that "there's also a chance that if Intel can produce enough chips on time and on budget it could get more of the planned 70% [iPhone modem share]"

Perhaps this upside scenario is set to play out?

Business impact

Apple currently offers the following iPhone product lines:

iPhone SE

iPhone 6s/6s Plus

iPhone 7/7 Plus

iPhone 8/8 Plus

iPhone X

The iPhone SE and iPhone 6s-series devices don't use Intel modems at all, and I'd be surprised if Intel even had half of the modem orders for the iPhone 7-series, iPhone 8-series, and iPhone X devices.

As the iPhone 6s/6s Plus roll off and new models are introduced, Intel's share of Apple's cellular modem business is set to rise. Not only should Intel have a greater percentage of the modem shipments in Apple's latest (and best-selling) models, but its average cellular modem content in the legacy models should go up, too.

Moreover, if Intel is successful in capturing all of Apple's modem business in either this year's models or the following years' models, then the company could be on track to eventually be the sole cellular modem supplier for Apple's iPhones.

A while back, I estimated Intel's modem business from the iPhone at "over $1 billion per year in revenue." If Intel is successful in capturing all of Apple's cellular modem business, then the company could be set to rake in more than $2 billion per year in revenue.

That's not a game-changer for Intel, which is on track to generate more than $68 billion in revenue this year, but it'd certainly be a nice chunk of change.

More From The Motley Fool

Ashraf Eassa has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Apple. The Motley Fool has the following options: long January 2020 $150 calls on Apple and short January 2020 $155 calls on Apple. The Motley Fool has a disclosure policy.