Intelligent Systems' (NYSE:INS) Wonderful 809% Share Price Increase Shows How Capitalism Can Build Wealth

It hasn't been the best quarter for Intelligent Systems Corporation (NYSE:INS) shareholders, since the share price has fallen 18% in that time. But that doesn't undermine the fantastic longer term performance (measured over five years). To be precise, the stock price is 809% higher than it was five years ago, a wonderful performance by any measure. So it might be that some shareholders are taking profits after good performance. The most important thing for savvy investors to consider is whether the underlying business can justify the share price gain.

Anyone who held for that rewarding ride would probably be keen to talk about it.

View our latest analysis for Intelligent Systems

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

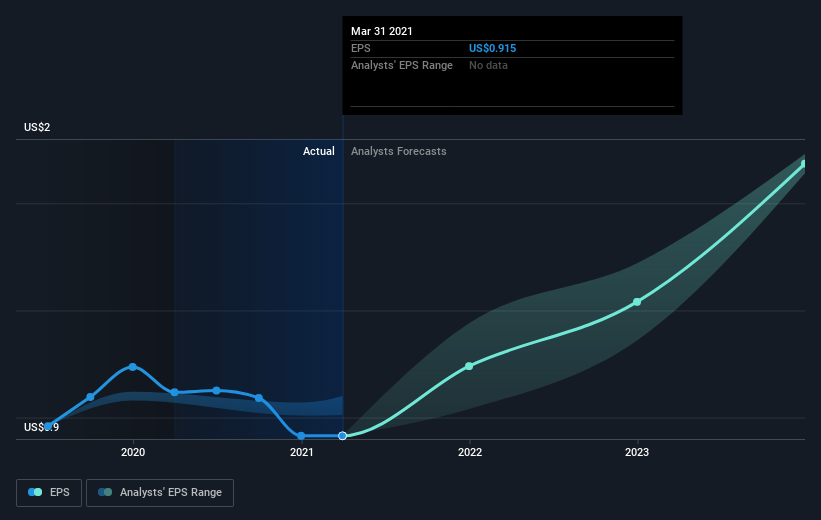

During the last half decade, Intelligent Systems became profitable. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains. Given that the company made a profit three years ago, but not five years ago, it is worth looking at the share price returns over the last three years, too. We can see that the Intelligent Systems share price is up 288% in the last three years. In the same period, EPS is up 65% per year. That makes the EPS growth rather close to the annualized share price gain of 57% over the same period. So one might argue that investor sentiment towards the stock hss not changed much over time. Rather, the share price has approximately tracked EPS growth.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that Intelligent Systems has improved its bottom line over the last three years, but what does the future have in store? This free interactive report on Intelligent Systems' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Intelligent Systems shareholders are down 8.0% for the year, but the market itself is up 42%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 56% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Intelligent Systems better, we need to consider many other factors. Even so, be aware that Intelligent Systems is showing 2 warning signs in our investment analysis , and 1 of those is potentially serious...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.