Interactive Brokers (IBKR) Q3 Earnings Down, Revenues Up Y/Y

Interactive Brokers Group IBKR recorded third-quarter 2019 earnings per share of 45 cents. The figure compared unfavorably with the prior-year quarter’s earnings of 51 cents.

Results were adversely impacted by rise in operating expenses and lower interest rates. However, the Electronic Brokerage segment’s performance was decent in the quarter. Also, increase in revenues and rise in daily average revenue trades (DARTs) acted as tailwinds.

Interactive Brokers reported comprehensive income available to common shareholders of $30 million or 39 cents per share, down from $38 million or 50 cents per share in the prior-year quarter.

Revenues & Expenses Rise

Total net revenues were $466 million, up 6.2% year over year. The rise was driven by higher commissions and interest income as well as stable trading gains, which were partially offset by rise in interest expenses. However, the top line lagged the Zacks Consensus Estimate of $483 million.

Total non-interest expenses increased 13.5% from the year-ago quarter to $185 million. Rise in all expense components except for communications costs were the reasons behind this increase.

Income before income taxes was $281 million, down 1.8% from the prior-year quarter. Pre-tax profit margin was 60%, down from 63% a year ago.

Quarterly Segmental Performance

Electronic Brokerage: Net revenues increased 14% year over year to $506 million. Pre-tax income rose 13.4% to $331 million. Total DARTs for cleared and execution-only customers were 859,000, up 12.6% from the year-ago quarter. Pre-tax profit margin was 65%, down from 66%.

Market Making: Net revenues were $17 million, up 6.3% from the prior-year quarter. Pre-tax income was $8 million, up 14.3%. Pre-tax profit margin was 47% compared with 44% in the year-ago quarter.

The Corporate segment reported negative revenues of $57 million compared with negative revenues of $21 million in the year-ago quarter. Pre-tax loss was $58 million compared with loss of $23 million a year ago.

Strong Capital Position

As of Sep 30, 2019, cash and cash equivalents (including cash and securities set aside for regulatory purposes) totaled $33.1 billion compared with $25.7 billion as of Dec 31, 2018.

As of Sep 30, 2019, total assets were $67.8 billion compared with $60.5 billion on Dec 31, 2018. Total equity was $7.7 billion compared with $7.2 billion at the end of December 2018.

Our Take

Interactive Brokers is poised to capitalize on growth prospects, backed by its market-leading position, technological advancement and optimization of resource allocation across global electronic networks. However, higher expenses witnessed in the quarter and lower interest rates pose major concerns.

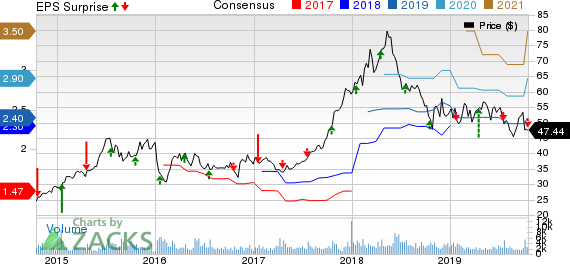

Interactive Brokers Group, Inc. Price, Consensus and EPS Surprise

Interactive Brokers Group, Inc. price-consensus-eps-surprise-chart | Interactive Brokers Group, Inc. Quote

Currently, Interactive Brokers carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance and Upcoming Releases of Other Investment Brokers

Charles Schwab’s SCHW third-quarter 2019 adjusted earnings of 74 cents per share beat the Zacks Consensus Estimate of 65 cents. Also, the bottom line increased 14% from the prior-year quarter. Results in the reported quarter included severance charges of $62 million (4 cents per share) related to position eliminations.

E*TRADE Financial ETFC and TD Ameritrade AMTD are set to announce results on Oct 17 and Oct 21, respectively.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our just-released Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

Download Free Report Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

TD Ameritrade Holding Corporation (AMTD) : Free Stock Analysis Report

The Charles Schwab Corporation (SCHW) : Free Stock Analysis Report

E*TRADE Financial Corporation (ETFC) : Free Stock Analysis Report

Interactive Brokers Group, Inc. (IBKR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research