Intercontinental (ICE) Beats Q3 Earnings & Revenue Estimates

Intercontinental Exchange ICE reported third-quarter 2019 adjusted earnings per share of $1.06, beating the Zacks Consensus Estimate by 11.6%. Also, the bottom line improved 24.7% on a year-over-year basis.

The company witnessed improved operating income and growth in business segments.

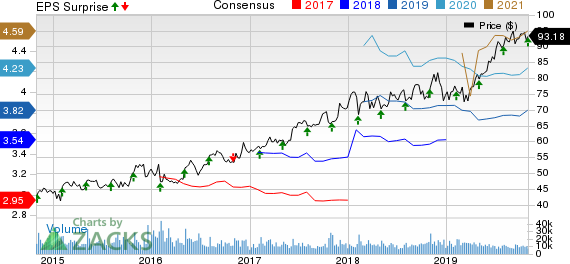

Intercontinental Exchange Inc. Price, Consensus and EPS Surprise

Intercontinental Exchange Inc. price-consensus-eps-surprise-chart | Intercontinental Exchange Inc. Quote

Performance in Detail

Intercontinental Exchange’s revenues of $1.3 billion increased 11% year over year on higher transaction and clearing, data services and other revenues. Moreover, the top line beat the Zacks Consensus Estimate by 1.16%.

Net revenues of Trading and Clearing segment were $669 million, up 20% year over year, while Data and Listings revenues were $667 million, up 4% year over year.

Total operating expenses rose 5.4% year over year to $630 million, primarily due to higher compensation and benefits, professional services, technology and communication, depreciation and amortization. Adjusted operating expenses were $551 million in the third quarter, up 5.8% from the year-ago quarter’s figure.

Adjusted operating income improved 15.6% year over year to $785 million. Adjusted operating margin contracted 200 basis points (bps) from the year-ago quarter to 59%.

Trading and Clearing's adjusted operating income of $438 million was up 24.4% year over year. Adjusted operating margin expanded 200 bps. Data and Listings' adjusted operating income rose 6.1% year over year to $347 million and adjusted operating margin of 52% expanded 100 bps.

Total Futures & Options totaled 5.8 million contracts, up 12% year over year. Revenue per contract of $1.10 increased 2% year over year.

Financial Update

As of Sep 30, 2019, Intercontinental Exchange had cash and cash equivalents of $655 million, down 9.5% from the level as of Dec 31, 2018.

Long-term debt of $6.5 billion was up 0.1% from 2018-end level.

Total equity was $17.2 billion as of Sep 30, 2019, down 0.3% from the level as of Dec 31, 2018.

Operating cash flow was $1.9 billion in the third quarter of 2019, up 11.8% year over year. Free cash flow was $1.7 billion, up 3.4% year over year.

Share Repurchase and Dividend Update

In the third quarter of 2019, the company bought back shares worth $1.1 billion and paid out dividends amounting to $467 million.

Q4 Guidance

Data revenues are estimated between $555 million and $560 million.

Operating expenses are projected in the range of $637-$647 million. Adjusted operating expenses are expected to be in the range of $562 million to $572 million.

The company expects interest expense of $71 million in the period.

Weighted average shares outstanding are anticipated between 557 million and 563 million.

Zacks Rank

Intercontinental Exchange currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Releases

Of the finance industry players that have reported third-quarter results so far, American Financial Group, Inc. AFG, Arthur J. Gallagher AJG and CNA Financial Corporation CNA beat the respective Zacks Consensus Estimate for earnings.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our just-released Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

Download Free Report Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Arthur J. Gallagher & Co. (AJG) : Free Stock Analysis Report

CNA Financial Corporation (CNA) : Free Stock Analysis Report

American Financial Group, Inc. (AFG) : Free Stock Analysis Report

Intercontinental Exchange Inc. (ICE) : Free Stock Analysis Report

To read this article on Zacks.com click here.