Is InterDigital Inc’s (IDCC) ROE Of 48.71% Sustainable?

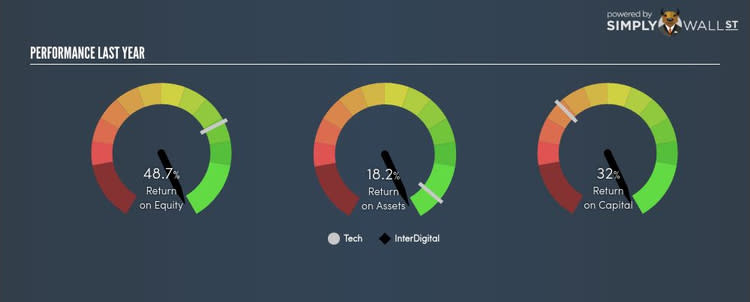

InterDigital Inc (NASDAQ:IDCC) delivered an ROE of 48.71% over the past 12 months, which is an impressive feat relative to its industry average of 16.61% during the same period. Though, the impressiveness of IDCC’s ROE is contingent on whether this industry-beating level can be sustained. A measure of sustainable returns is IDCC’s financial leverage. If IDCC borrows debt to invest in its business, its profits will be higher. But ROE does not capture any debt, so we only see high profits and low equity, which is great on the surface. But today let’s take a deeper dive below this surface. View our latest analysis for InterDigital

What you must know about ROE

Return on Equity (ROE) weighs IDCC’s profit against the level of its shareholders’ equity.It essentially shows how much IDCC can generate in earnings given the amount of equity it has raised.If investors diversify their portfolio by industry, they may want to maximise their return in the Communications Equipment sector by investing in the highest returning stock.However, this can be misleading as each firm has different costs of equity and debt levels i.e. the more debt IDCC has, the higher ROE is pumped up in the short term, at the expense of long term interest payment burden.

Return on Equity = Net Profit ÷ Shareholders Equity

ROE is measured against cost of equity in order to determine the efficiency of IDCC’s equity capital deployed. Its cost of equity is 10.16%. This means IDCC returns enough to cover its own cost of equity, with a buffer of 38.55%. This sustainable practice implies that the company pays less for its capital than what it generates in return. ROE can be split up into three useful ratios: net profit margin, asset turnover, and financial leverage. This is called the Dupont Formula:

Dupont Formula

ROE = profit margin × asset turnover × financial leverage

ROE = (annual net profit ÷ sales) × (sales ÷ assets) × (assets ÷ shareholders’ equity)

ROE = annual net profit ÷ shareholders’ equity

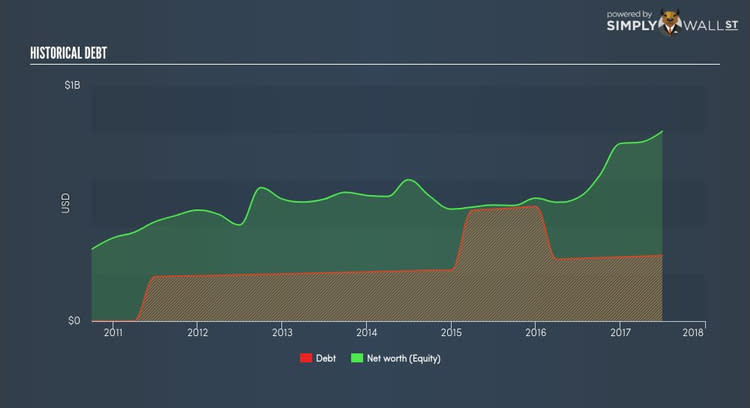

Basically, profit margin measures how much of revenue trickles down into earnings which illustrates how efficient IDCC is with its cost management.Asset turnover shows how much revenue IDCC can generate with its current asset base.The most interesting ratio, and reflective of sustainability of its ROE, is financial leverage.We can determine if IDCC’s ROE is inflated by borrowing high levels of debt. Generally, a balanced capital structure means its returns will be sustainable over the long run. We can examine this by looking at IDCC’s debt-to-equity ratio. Currently the ratio stands at 34.56%, which is very low. This means IDCC has not taken on leverage, and its above-average ROE is driven by its ability to grow its profit without a huge debt burden.

Why is ROE called the mother of all ratios

ROE is a simple yet informative ratio, illustrating the various components that each measure the quality of the overall stock. IDCC’s ROE is impressive relative to the industry average and also covers its cost of equity. Its high ROE is not likely to be driven by high debt. Therefore, investors may have more confidence in the sustainability of this level of returns going forward. However, there are other crucial measures we need to account for before determining whether or not its returns are sustainable. I recommend you see our latest FREE analysis report to find out more about other measures!

If you are not interested in IDCC anymore, you can use our free platform to see my list of stocks with Return on Equity over 20%.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.