Interested In The Tech Industry? Take A Look At ClearOne Inc (NASDAQ:CLRO)

ClearOne Inc (NASDAQ:CLRO), is a USD$72.78M small-cap, which operates in the tech hardware industry based in United States. While mobile and cloud computing become ubiquitous, there is a new wave of advancement emerging from innovations such as machine learning, robotics and augmented reality. Tech analysts are forecasting for the entire hardware tech industry, negative growth in the upcoming year . Today, I will analyse the industry outlook, as well as evaluate whether ClearOne is lagging or leading in the industry. See our latest analysis for ClearOne

What’s the catalyst for ClearOne’s sector growth?

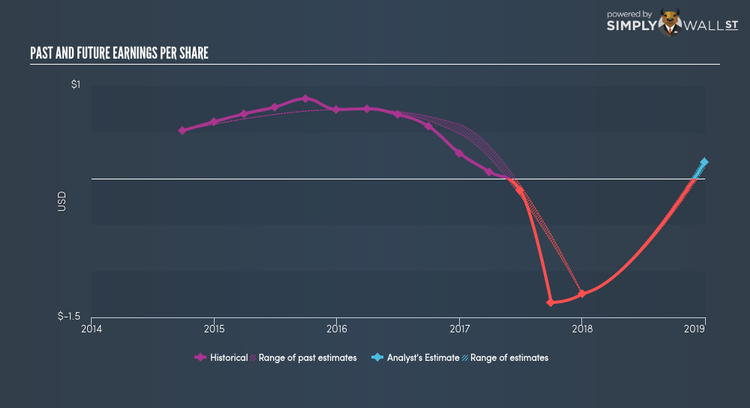

The battle for competitive advantage has led businesses to adopt new the cutting-edge technology, or risk being left behind. Many technologies are now coming into their own as their power and speed increase and the cost of delivering them goes down. And some are pursing growth through various strategies including new M&A, collaboration and alliances, as well as cost reduction and organic growth. In the past year, the industry delivered growth in the teens, beating the US market growth of 10.81%. ClearOne lags the pack with its earnings falling by more than half over the past year, which indicates the company will be growing at a slower pace than its tech hardware peers. However, the future seems brighter, as analysts expect an industry-beating growth rate of 86.35% in the upcoming year.

Is ClearOne and the sector relatively cheap?

Tech hardware companies are typically trading at a PE of 21x, relatively similar to the rest of the US stock market PE of 20x. This illustrates a fairly valued sector relative to the rest of the market, indicating low mispricing opportunities. Furthermore, the industry returned a similar 8.66% on equities compared to the market’s 10.46%. Since ClearOne’s earnings doesn’t seem to reflect its true value, its PE ratio isn’t very useful. A loose alternative to gauge ClearOne’s value is to assume the stock should be relatively in-line with its industry.

What this means for you:

Are you a shareholder? ClearOne’s industry-beating future is a positive for shareholders, indicating they’ve backed a fast-growing horse. If you’re bullish on the stock and well-diversified by industry, you may decide to hold onto ClearOne as part of your portfolio. However, if you’re relatively concentrated in tech, you may want to value ClearOne based on its cash flows to determine if it is overpriced based on its current growth outlook.

Are you a potential investor? If ClearOne has been on your watchlist for a while, now may be the time to enter into the stock, if you like its growth prospects and are not highly concentrated in the tech industry. Before you make a decision on the stock, take a look at ClearOne’s cash flows and assess whether the stock is trading at a fair price.

For a deeper dive into ClearOne’s stock, take a look at the company’s latest free analysis report to find out more on its financial health and other fundamentals. Interested in other tech stocks instead? Use our free playform to see my list of over 1000 other tech companies trading on the market.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.