International Business Machines' (NYSE:IBM) Dividend Will Be Increased To US$1.64

International Business Machines Corporation (NYSE:IBM) will increase its dividend on the 10th of September to US$1.64. This will take the annual payment to 4.6% of the stock price, which is above what most companies in the industry pay.

Check out our latest analysis for International Business Machines

International Business Machines' Earnings Easily Cover the Distributions

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Based on the last payment, International Business Machines' profits didn't cover the dividend, but the company was generating enough cash instead. Generally, we think cash is more important than accounting measures of profit, so with the cash flows easily covering the dividend, we don't think there is much reason to worry.

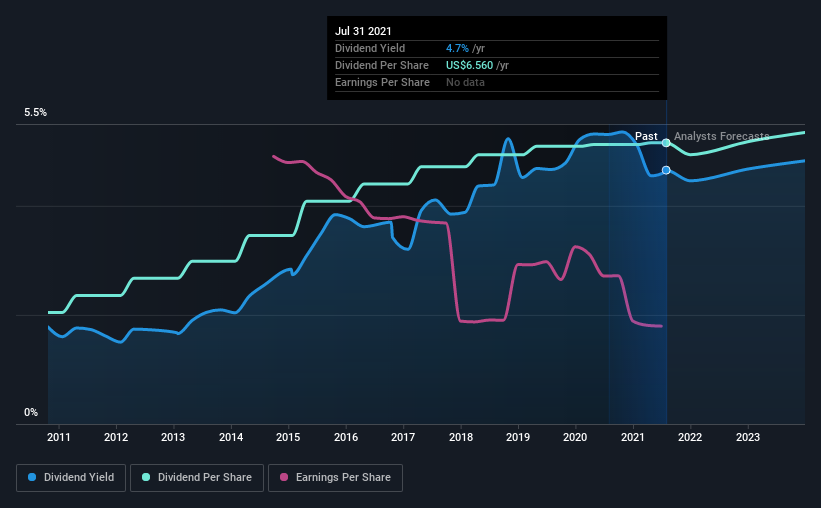

Earnings per share is forecast to rise by 47.9% over the next year. If the dividend continues growing along recent trends, we estimate the payout ratio could reach 80%, which is on the higher side, but certainly still feasible.

International Business Machines Has A Solid Track Record

Even over a long history of paying dividends, the company's distributions have been remarkably stable. The dividend has gone from US$2.60 in 2011 to the most recent annual payment of US$6.56. This implies that the company grew its distributions at a yearly rate of about 9.7% over that duration. Companies like this can be very valuable over the long term, if the decent rate of growth can be maintained.

Dividend Growth Potential Is Shaky

The company's investors will be pleased to have been receiving dividend income for some time. However, things aren't all that rosy. International Business Machines' EPS has fallen by approximately 14% per year during the past five years. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future. On the bright side, earnings are predicted to gain some ground over the next year, but until this turns into a pattern we wouldn't be feeling too comfortable.

In Summary

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. The company is generating plenty of cash, but we still think the dividend is a bit high for comfort. We don't think International Business Machines is a great stock to add to your portfolio if income is your focus.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. For instance, we've picked out 4 warning signs for International Business Machines that investors should take into consideration. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.