Interpublic (IPG) Beats on Q4 Earnings, Hikes Dividend by 5.9%

The Interpublic Group of Companies, Inc. IPG reported better-than-expected fourth-quarter 2020 results.

Adjusted earnings of 86 cents per share beat the Zacks Consensus Estimate by 4.9% but declined 2.3% on a year-over-year basis.

Net revenues of $2.28 billion marginally beat the consensus estimate but declined 21.3% on a year-over-year basis. The downside was caused by organic net revenues fall of 5.4% and negative 0.8% impact of net dispositions. Total revenues of $2.55 billion declined 12.1% year over year.

So far this year, shares of Interpublic have gained 13.1% against 8.6% decline of the industry it belongs to.

Let’s check out the numbers in detail.

Operating Results

Operating income in fourth-quarter 2020 came in at $223.4 million compared with $491.3 million in the prior-year quarter. Operating margin on net revenues fell to 9.8% from 20.2% in the year-ago quarter. Operating margin on total revenues fell to 8.8% from 16.9% in the year-ago quarter.

Adjusted EBITA came in at $244.9 million, compared with $512.7 million at the end of the prior-year quarter. Adjusted EBITA margin on net revenues declined to 10.7% from 21.1% in the year-ago quarter. Adjusted EBITA margin on total revenues rose to 9.6% from 17.6% in the year-ago quarter.

Total operating expenses of $2.33 billion declined 3.5% year over year.

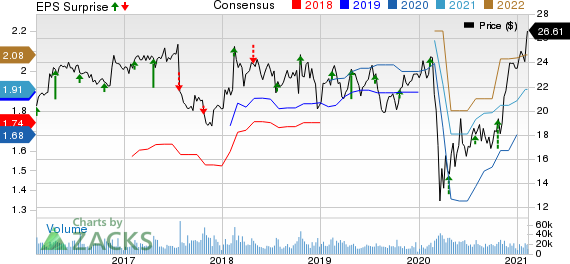

Interpublic Group of Companies, Inc. The Price, Consensus and EPS Surprise

Interpublic Group of Companies, Inc. The price-consensus-eps-surprise-chart | Interpublic Group of Companies, Inc. The Quote

Balance Sheet

As of Dec 31, 2020, Interpublic had cash and cash equivalents of $2.51 billion compared with $1.63 billion at the end of the prior quarter. Total debt was $3.47 billion compared with $3.96 billion at the end of the prior quarter.

Dividend Hike

On Feb 10, 2021, the company announced that its board of directors declared a cash dividend of 27 cents per share, up 5.9% from its prior dividend of 25.5 cents. The dividend will be payable to its shareholders on Mar 15, as of record date Mar 1.

During the quarter the company paid out a cash dividend of 25.5 cents per share, amounting to $99.5 million.

Currently, Interpublic carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Business Services Companies

Rollins’ ROL fourth-quarter 2020 adjusted earnings of 13 cents per share came ahead of the consensus estimate and increased 18.2% year over year. Revenues of $536.3 million beat the consensus mark by 1.7% and rose 6% year over year.

IHS Markit’s INFO fourth-quarter 2020 adjusted earnings per share of 72 cents beat the Zacks Consensus Estimate by 7.5% and increased 11% on a year-over-year basis. Total revenues came in at $1.11 billion, marginally missing the consensus mark and declining 1% from the year-ago quarter’s level.

Automatic Data Processing’s ADP second-quarter fiscal 2021 adjusted earnings per share of $1.52 beat the consensus mark by 17.8% and were flat year over year. Total revenues of $3.69 billion beat the consensus mark by 3.2% and inched up 0.7% year over year.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.9% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Automatic Data Processing, Inc. (ADP) : Free Stock Analysis Report

Interpublic Group of Companies, Inc. The (IPG) : Free Stock Analysis Report

Rollins, Inc. (ROL) : Free Stock Analysis Report

IHS Markit Ltd. (INFO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research