Interpublic (IPG) to Report Q1 Earnings: What's in Store?

The Interpublic Group of Companies, Inc. IPG is scheduled to report first-quarter 2018 results on Apr 27, before the opening bell.

While we expect the company to witness solid sales on the back of higher organic growth, favorable foreign currency movements and extensive global presence, seasonality in business is likely to hurt the bottom line.

We observe that shares of Interpublic have rallied 19.7% over the past six months, significantly outperforming the S&P 500’s gain of 4.6%. The industry to which it belongs, declined 1.6% in the same time frame.

Organic Growth & Favorable Currency to Drive Revenues

The Zacks Consensus Estimate for revenues for the to-be-reported quarter stands at $1,815 million, reflecting year-over-year growth of 3.5%. The top line is expected to benefit from higher organic growth and favorable foreign currency movements.

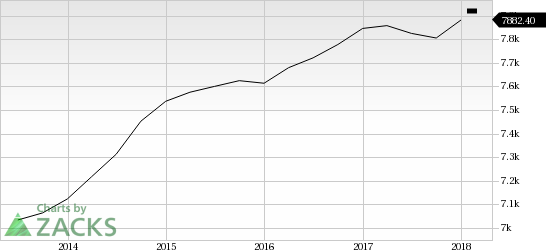

Interpublic Group of Companies, Inc. (The) Revenue (TTM)

Interpublic Group of Companies, Inc. (The) Revenue (TTM) | Interpublic Group of Companies, Inc. (The) Quote

Further, strategic investments and acquisitions to expand in key global markets augur well.

The Zacks Consensus Estimate for revenues from United States is pegged at $1,128 million, reflecting year-over-year growth of 1.4%.In fourth-quarter 2017, segment revenues climbed 2.2% year over year to $1,286 million.

The Zacks Consensus Estimate for revenues from international markets is pegged at $681 million, reflecting year-over-year growth of 6.1%. In fourth-quarter 2017, segment revenues advanced 4.9% year over year to $1,055 million.

Additionally, the company’s Integrated Agency Networks segment looks strong, backed by excellent performance of IPG Mediabrands, McCann World Group, FCB and Deutsch. The company is anticipated to achieve targeted levels in the upcoming quarters based on diversification across emerging regions along with collaboration and integration across agencies through technological improvement.

In fourth-quarter 2017, revenues rose 3.4% from the year-ago quarter to $2,341 million (inclusive of favorable foreign currency movement of 1.2% and organic growth of 3.3%). There was a negative impact of 1.1% from net divestures.

Bottom Line to Decline Year Over Year

The Zacks Consensus Estimate for earnings per share is pegged at 4 cents, indicating year-over-year decline of 20%. The company’s earnings are likely to be negatively impacted by seasonality in business that results from clients’ fluctuating annual media spending budgets and changing media spending patterns. A significant impact of this seasonality is observed in the first quarter. This will however be partially offset by the benefits from the tax reform.

In fourth-quarter 2017, adjusted earnings rose 5.3% from the year-ago quarter to 79 cents per share. The company witnessed a tax benefit (as a result of lower tax) of $31 million in fourth-quarter 2017.

Our Model Doesn’t Suggest a Beat

Please note that according to the Zacks model, a company with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) has a good chance of beating estimates if it also has a positive Earnings ESP. Zacks Rank #4 (Sell) or 5 (Strong Sell) stocks are best avoided, especially if they have a negative Earnings ESP. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Interpublic has a Zacks Rank #2 and an Earnings ESP of -6.67%, a combination that complicates our surprise prediction.

Stocks to Consider

Here are some stocks from the broader Business Services sector that investors may consider, as our model shows that these have the right combination of elements to beat on earnings in first-quarter 2018:

Mastercard Incorporated MA has an Earnings ESP of +0.83% and a Zacks Rank #2. The company is slated to report quarterly numbers on May 2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Brink’s Company BCO has an Earnings ESP of +5.25% and a Zacks Rank #2. The company is slated to report quarterly results on Apr 25.

FLEETCOR Technologies, Inc. FLT has an Earnings ESP of +0.37% and a Zacks Rank #2. The company is expected to report quarterly numbers on May 7.

Investor Alert: Breakthroughs Pending

A medical advance is now at the flashpoint between theory and realization. Billions of dollars in research have poured into it. Companies are already generating substantial revenue, and even more wondrous products are in the pipeline.

Cures for a variety of deadly diseases are in sight, and so are big potential profits for early investors. Zacks names 5 stocks to buy now.

Click here to see them >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Interpublic Group of Companies, Inc. (The) (IPG) : Free Stock Analysis Report

FleetCor Technologies, Inc. (FLT) : Free Stock Analysis Report

Brink's Company (The) (BCO) : Free Stock Analysis Report

Mastercard Incorporated (MA) : Free Stock Analysis Report

To read this article on Zacks.com click here.