Introducing Arbutus Biopharma (NASDAQ:ABUS), The Stock That Zoomed 167% In The Last Year

Arbutus Biopharma Corporation (NASDAQ:ABUS) shareholders might be concerned after seeing the share price drop 18% in the last quarter. But that doesn't detract from the splendid returns of the last year. We're very pleased to report the share price shot up 167% in that time. So some might not be surprised to see the price retrace some. The real question is whether the business is trending in the right direction.

View our latest analysis for Arbutus Biopharma

Given that Arbutus Biopharma didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year Arbutus Biopharma saw its revenue grow by 15%. That's a fairly respectable growth rate. The revenue growth is decent but the share price had an even better year, gaining 167%. If the profitability is on the horizon then now could be a very exciting time to be a shareholder. But investors need to be wary of how the 'fear of missing out' could influence them to buy without doing thorough research.

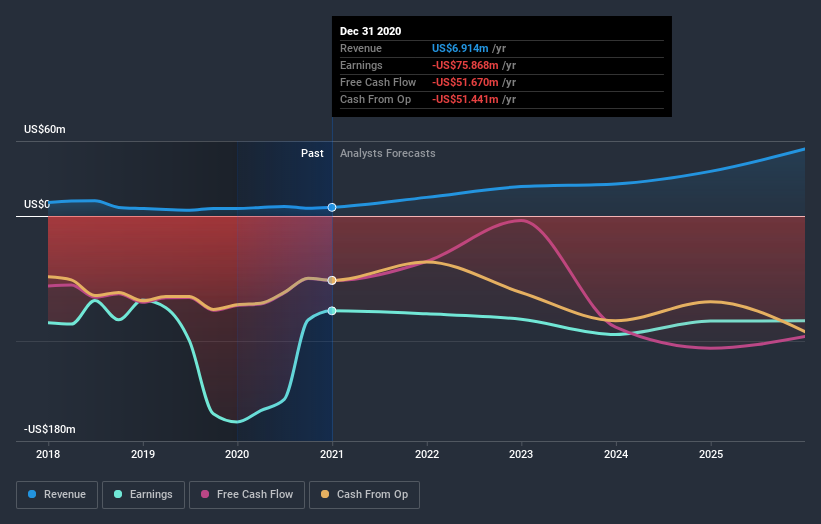

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's nice to see that Arbutus Biopharma shareholders have received a total shareholder return of 167% over the last year. That certainly beats the loss of about 6% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Arbutus Biopharma has 4 warning signs (and 1 which is a bit concerning) we think you should know about.

But note: Arbutus Biopharma may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.