Introducing Baidu (NASDAQ:BIDU), The Stock That Dropped 37% In The Last Year

Investors can approximate the average market return by buying an index fund. But if you buy individual stocks, you can do both better or worse than that. Unfortunately the Baidu, Inc. (NASDAQ:BIDU) share price slid 37% over twelve months. That’s well bellow the market return of 0.9%. Longer term shareholders haven’t suffered as badly, since the stock is down a comparatively less painful 9.4% in three years. It’s up 2.2% in the last seven days.

See our latest analysis for Baidu

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the unfortunate twelve months during which the Baidu share price fell, it actually saw its earnings per share (EPS) improve by 50%. It could be that the share price was previously over-hyped. The divergence between the EPS and the share price is quite notable, during the year. So it’s well worth checking out some other metrics, too.

Baidu’s revenue is actually up 21% over the last year. Since we can’t easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

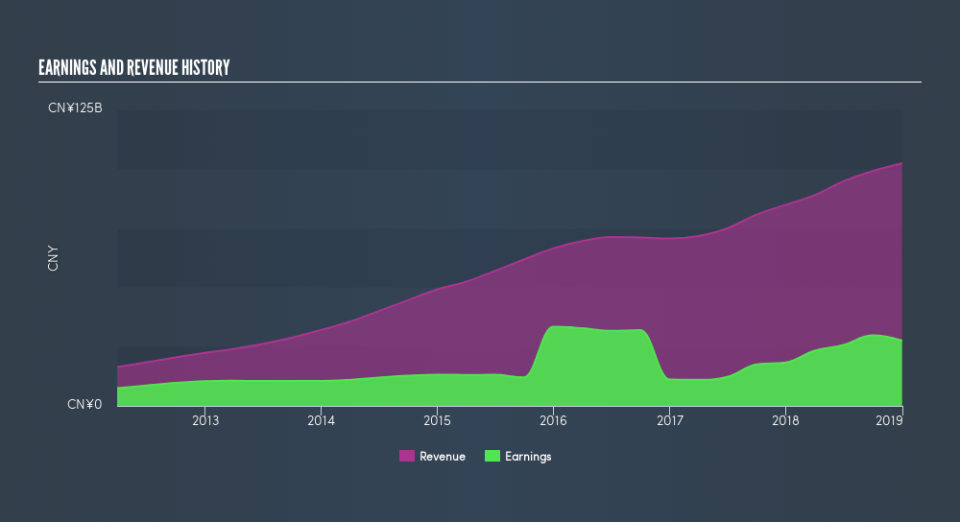

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

Baidu is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So it makes a lot of sense to check out what analysts think Baidu will earn in the future (free analyst consensus estimates)

A Different Perspective

While the broader market gained around 0.9% in the last year, Baidu shareholders lost 37%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn’t be so upset, since they would have made 0.6%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Before forming an opinion on Baidu you might want to consider these 3 valuation metrics.

But note: Baidu may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.