Introducing Canfor Pulp Products (TSE:CFX), The Stock That Slid 55% In The Last Year

Investing in stocks comes with the risk that the share price will fall. Unfortunately, shareholders of Canfor Pulp Products Inc. (TSE:CFX) have suffered share price declines over the last year. To wit the share price is down 55% in that time. However, the longer term returns haven't been so bad, with the stock down 20% in the last three years.

See our latest analysis for Canfor Pulp Products

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

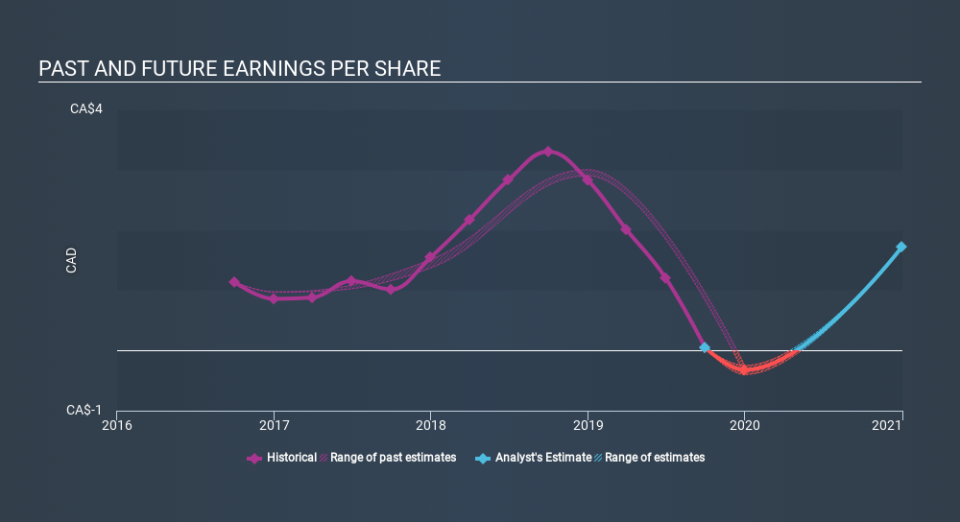

Unhappily, Canfor Pulp Products had to report a 99% decline in EPS over the last year. The share price fall of 55% isn't as bad as the reduction in earnings per share. So despite the weak per-share profits, some investors are probably relieved the situation wasn't more difficult. Indeed, with a P/E ratio of 168.02 there is obviously some real optimism that earnings will bounce back.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into Canfor Pulp Products's key metrics by checking this interactive graph of Canfor Pulp Products's earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Canfor Pulp Products's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that Canfor Pulp Products's TSR, which was a 54% drop over the last year, was not as bad as the share price return.

A Different Perspective

Canfor Pulp Products shareholders are down 54% for the year (even including dividends) , but the market itself is up 11%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 5.0% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Importantly, we haven't analysed Canfor Pulp Products's dividend history. This free visual report on its dividends is a must-read if you're thinking of buying.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.