Introducing Conformis (NASDAQ:CFMS), The Stock That Zoomed 170% In The Last Year

Unless you borrow money to invest, the potential losses are limited. But when you pick a company that is really flourishing, you can make more than 100%. For example, the Conformis, Inc. (NASDAQ:CFMS) share price had more than doubled in just one year - up 170%. Shareholders are also celebrating an even better 181% rise, over the last three months. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report. In contrast, the longer term returns are negative, since the share price is 43% lower than it was three years ago.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

View our latest analysis for Conformis

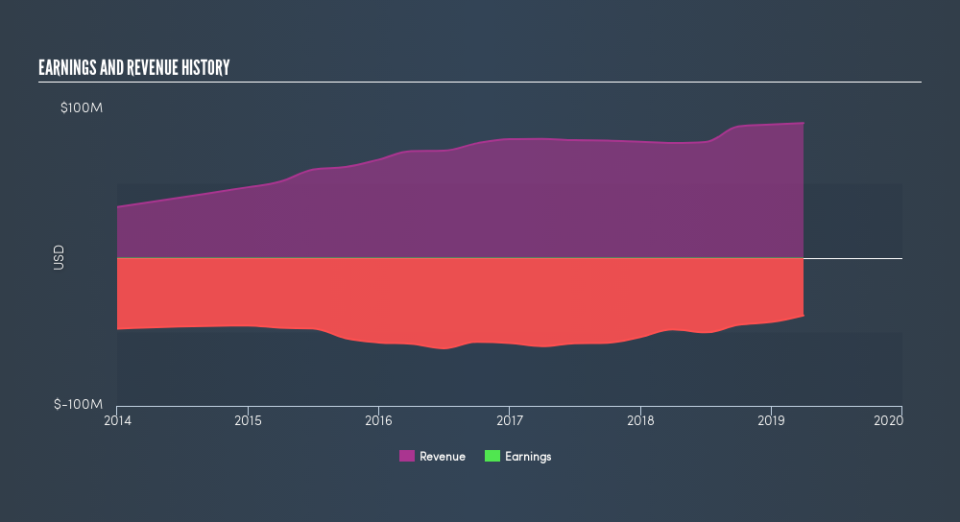

Conformis isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Conformis grew its revenue by 17% last year. That's a fairly respectable growth rate. The revenue growth is decent but the share price had an even better year, gaining 170%. Given that the business has made good progress on the top line, it would be worth taking a look at its path to profitability. But investors need to be wary of how the 'fear of missing out' could influence them to buy without doing thorough research.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We're pleased to report that Conformis rewarded shareholders with a total shareholder return of 170% over the last year. What is absolutely clear is that is far preferable to the dismal 17% average annual loss suffered over the last three years. The optimist would say this is evidence that the stock has bottomed, and better days lie ahead. Before spending more time on Conformis it might be wise to click here to see if insiders have been buying or selling shares.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.