Introducing Deutsche Bank (ETR:DBK), The Stock That Slid 70% In The Last Five Years

While it may not be enough for some shareholders, we think it is good to see the Deutsche Bank Aktiengesellschaft (ETR:DBK) share price up 18% in a single quarter. But that can't change the reality that over the longer term (five years), the returns have been really quite dismal. In that time the share price has delivered a rude shock to holders, who find themselves down 70% after a long stretch. So we're hesitant to put much weight behind the short term increase. We'd err towards caution given the long term under-performance.

Check out our latest analysis for Deutsche Bank

Given that Deutsche Bank didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over half a decade Deutsche Bank reduced its trailing twelve month revenue by 7.1% for each year. That's not what investors generally want to see. With neither profit nor revenue growth, the loss of 21% per year doesn't really surprise us. We don't think anyone is rushing to buy this stock. Ultimately, it may be worth watching - should revenue pick up, the share price might follow.

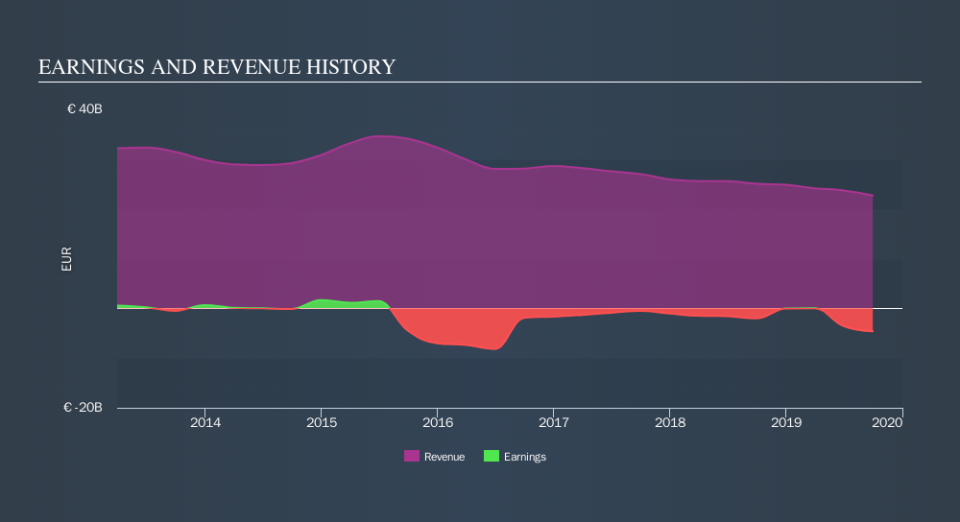

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Deutsche Bank is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So it makes a lot of sense to check out what analysts think Deutsche Bank will earn in the future (free analyst consensus estimates)

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Deutsche Bank's TSR for the last 5 years was -64%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Investors in Deutsche Bank had a tough year, with a total loss of 0.8% (including dividends) , against a market gain of about 20%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 18% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. You could get a better understanding of Deutsche Bank's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.