Introducing Energy World (ASX:EWC), The Stock That Tanked 81%

Energy World Corporation Ltd (ASX:EWC) shareholders should be happy to see the share price up 17% in the last quarter. But will that repair the damage for the weary investors who have owned this stock as it declined over half a decade? Probably not. Indeed, the share price is down a whopping 81% in that time. While the recent increase might be a green shoot, we're certainly hesitant to rejoice. The fundamental business performance will ultimately determine if the turnaround can be sustained.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

Check out our latest analysis for Energy World

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

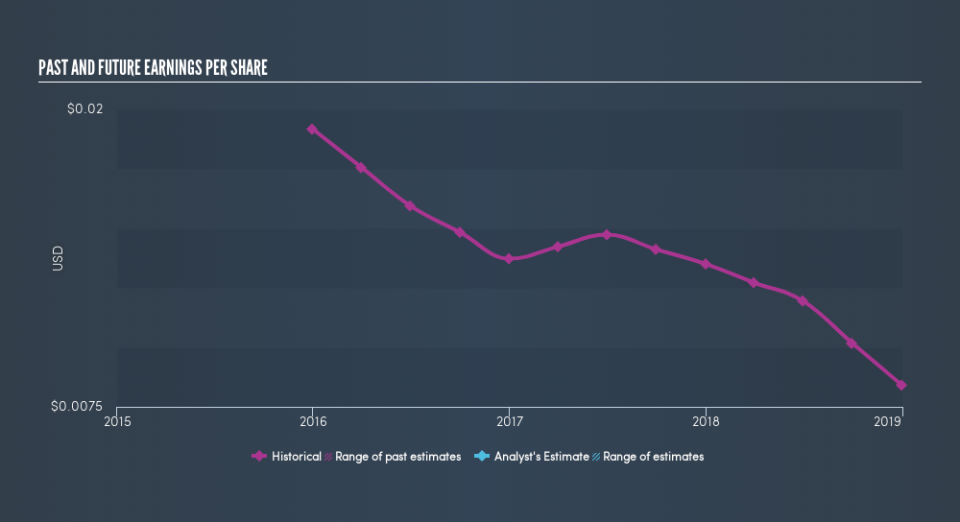

During the five years over which the share price declined, Energy World's earnings per share (EPS) dropped by 2.4% each year. Readers should note that the share price has fallen faster than the EPS, at a rate of 28% per year, over the period. This implies that the market was previously too optimistic about the stock. The less favorable sentiment is reflected in its current P/E ratio of 5.60.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Dive deeper into Energy World's key metrics by checking this interactive graph of Energy World's earnings, revenue and cash flow.

A Different Perspective

Energy World shareholders are down 53% for the year, but the market itself is up 6.3%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 28% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

Of course Energy World may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.