Introducing Himax Technologies (NASDAQ:HIMX), The Stock That Slid 67% In The Last Three Years

If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. But the last three years have been particularly tough on longer term Himax Technologies, Inc. (NASDAQ:HIMX) shareholders. Unfortunately, they have held through a 67% decline in the share price in that time. And more recent buyers are having a tough time too, with a drop of 61% in the last year. Even worse, it's down 10% in about a month, which isn't fun at all.

See our latest analysis for Himax Technologies

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

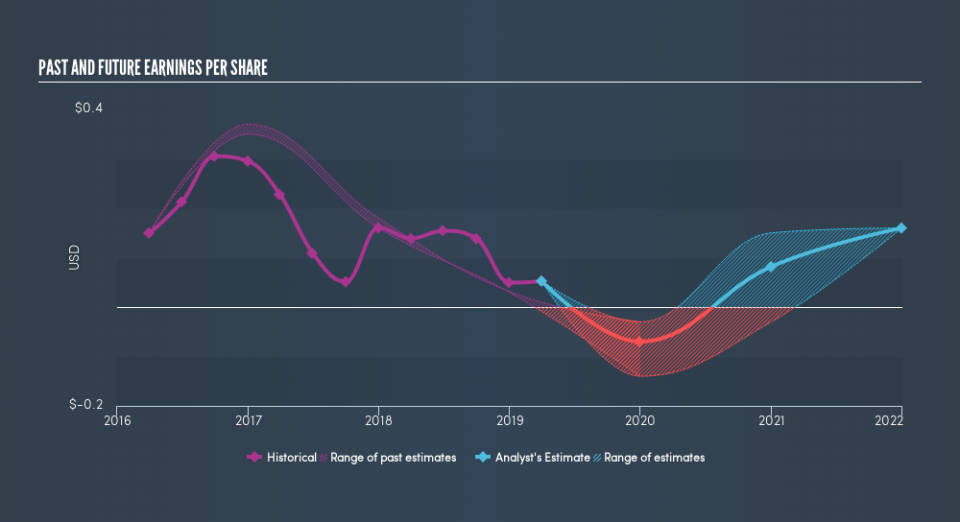

Himax Technologies saw its EPS decline at a compound rate of 29% per year, over the last three years. So do you think it's a coincidence that the share price has dropped 31% per year, a very similar rate to the EPS? We don't. So it seems like sentiment towards the stock hasn't changed all that much over time. In this case, it seems that the EPS is guiding the share price.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What about the Total Shareholder Return (TSR)?

We've already covered Himax Technologies's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Himax Technologies's TSR of was a loss of 66% for the 3 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

Himax Technologies shareholders are down 61% for the year (even including dividends), but the market itself is up 5.6%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 11% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Before forming an opinion on Himax Technologies you might want to consider the cold hard cash it pays as a dividend. This free chart tracks its dividend over time.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.