Introducing A and M Jumbo Bags (NSE:AMJUMBO), The Stock That Dropped 49% In The Last Year

It's easy to match the overall market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. Unfortunately the A and M Jumbo Bags Limited (NSE:AMJUMBO) share price slid 49% over twelve months. That falls noticeably short of the market return of around 3.0%. We wouldn't rush to judgement on A and M Jumbo Bags because we don't have a long term history to look at. The falls have accelerated recently, with the share price down 37% in the last three months.

View our latest analysis for A and M Jumbo Bags

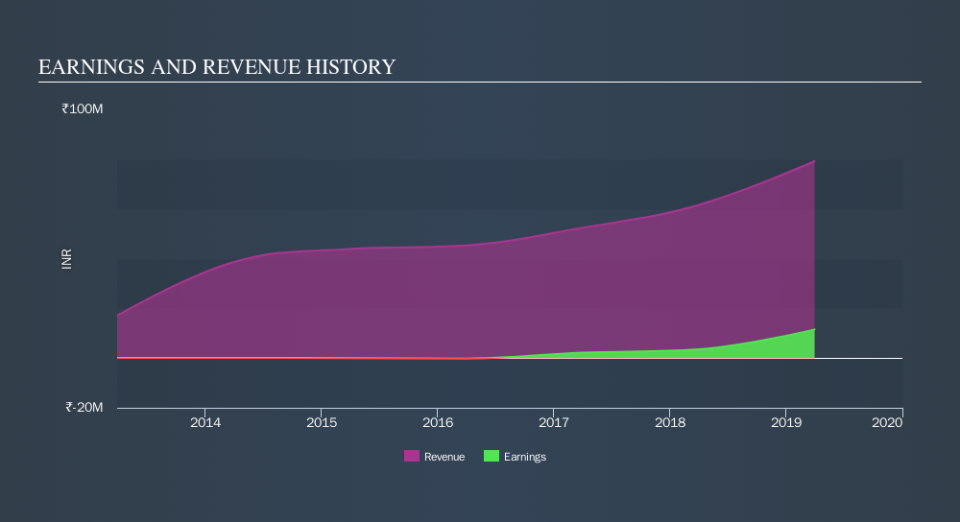

We don't think that A and M Jumbo Bags's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last year A and M Jumbo Bags saw its revenue grow by 29%. We think that is pretty nice growth. Unfortunately that wasn't good enough to stop the share price dropping 49%. You might even wonder if the share price was previously over-hyped. But if revenue keeps growing, then at a certain point the share price would likely follow.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling A and M Jumbo Bags stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

While A and M Jumbo Bags shareholders are down 49% for the year, the market itself is up 3.0%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. The share price decline has continued throughout the most recent three months, down 37%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

We will like A and M Jumbo Bags better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.