Introducing Megaport (ASX:MP1), The Stock That Soared 395% In The Last Three Years

Investing can be hard but the potential fo an individual stock to pay off big time inspires us. Mistakes are inevitable, but a single top stock pick can cover any losses, and so much more. One bright shining star stock has been Megaport Limited (ASX:MP1), which is 395% higher than three years ago. Also pleasing for shareholders was the 47% gain in the last three months.

View our latest analysis for Megaport

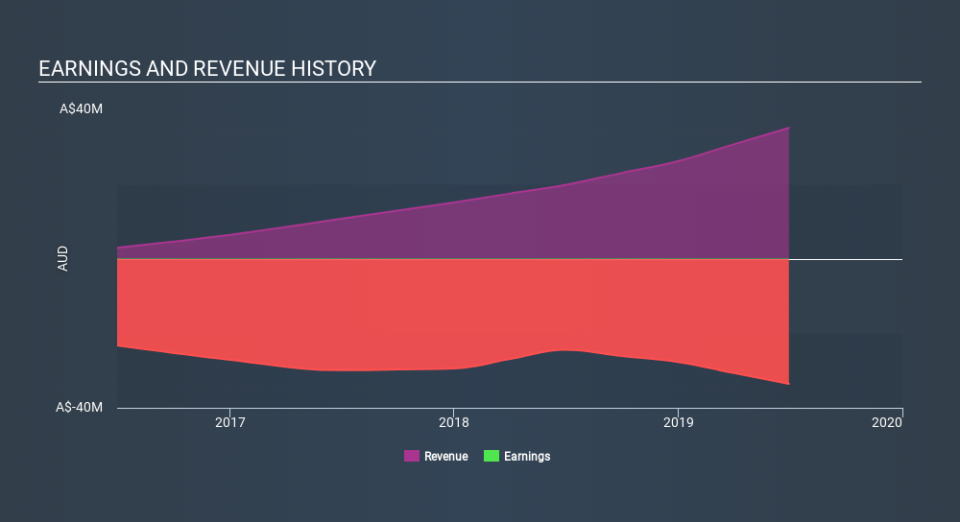

Given that Megaport didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last three years Megaport has grown its revenue at 58% annually. That's well above most pre-profit companies. In light of this attractive revenue growth, it seems somewhat appropriate that the share price has been rocketing, boasting a gain of 70% per year, over the same period. It's always tempting to take profits after a share price gain like that, but high-growth companies like Megaport can sometimes sustain strong growth for many years. So we'd recommend you take a closer look at this one, or even put it on your watchlist.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Megaport is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. You can see what analysts are predicting for Megaport in this interactive graph of future profit estimates.

A Different Perspective

It's nice to see that Megaport shareholders have gained 193% (in total) over the last year. That gain actually surpasses the 70% TSR it generated (per year) over three years. Given the track record of solid returns over varying time frames, it might be worth putting Megaport on your watchlist. It's always interesting to track share price performance over the longer term. But to understand Megaport better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for Megaport you should know about.

But note: Megaport may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.