Introducing Monash IVF Group (ASX:MVF), A Stock That Climbed 75% In The Last Year

If you want to compound wealth in the stock market, you can do so by buying an index fund. But if you pick the right individual stocks, you could make more than that. To wit, the Monash IVF Group Limited (ASX:MVF) share price is 75% higher than it was a year ago, much better than the market return of around 49% (not including dividends) in the same period. So that should have shareholders smiling. Zooming out, the stock is actually down 33% in the last three years.

Check out our latest analysis for Monash IVF Group

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year, Monash IVF Group actually saw its earnings per share drop 30%.

So we don't think that investors are paying too much attention to EPS. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

Absent any improvement, we don't think a thirst for dividends is pushing up the Monash IVF Group's share price. Rather, we'd posit that the revenue increase of 4.8% might be more meaningful. After all, it's not necessarily a bad thing if a business sacrifices profits today in pursuit of profit tomorrow (metaphorically speaking).

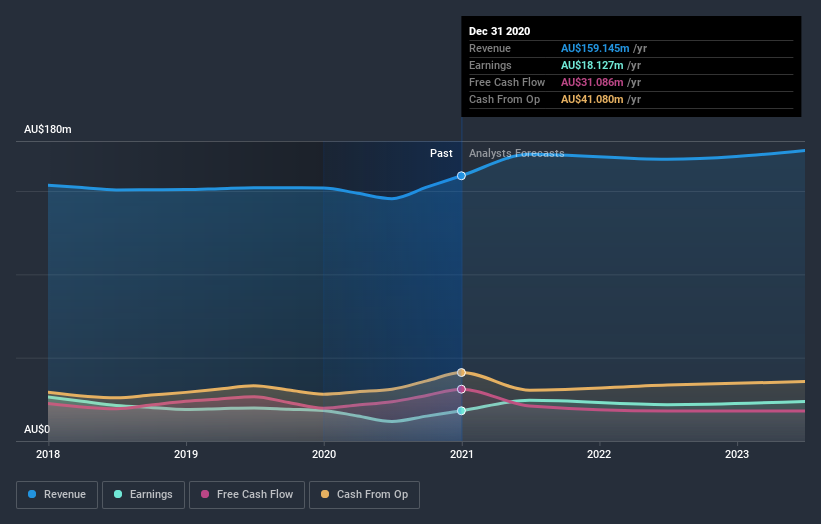

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So it makes a lot of sense to check out what analysts think Monash IVF Group will earn in the future (free profit forecasts).

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Monash IVF Group, it has a TSR of 92% for the last year. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's nice to see that Monash IVF Group shareholders have received a total shareholder return of 92% over the last year. And that does include the dividend. Notably the five-year annualised TSR loss of 7% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 2 warning signs we've spotted with Monash IVF Group (including 1 which makes us a bit uncomfortable) .

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.