Introducing Nine Energy Service (NYSE:NINE), The Stock That Dropped 32% In The Last Year

Investors can approximate the average market return by buying an index fund. But if you buy individual stocks, you can do both better or worse than that. That downside risk was realized by Nine Energy Service, Inc. (NYSE:NINE) shareholders over the last year, as the share price declined 32%. That contrasts poorly with the market return of 8.2%. Because Nine Energy Service hasn't been listed for many years, the market is still learning about how the business performs. The falls have accelerated recently, with the share price down 14% in the last three months.

See our latest analysis for Nine Energy Service

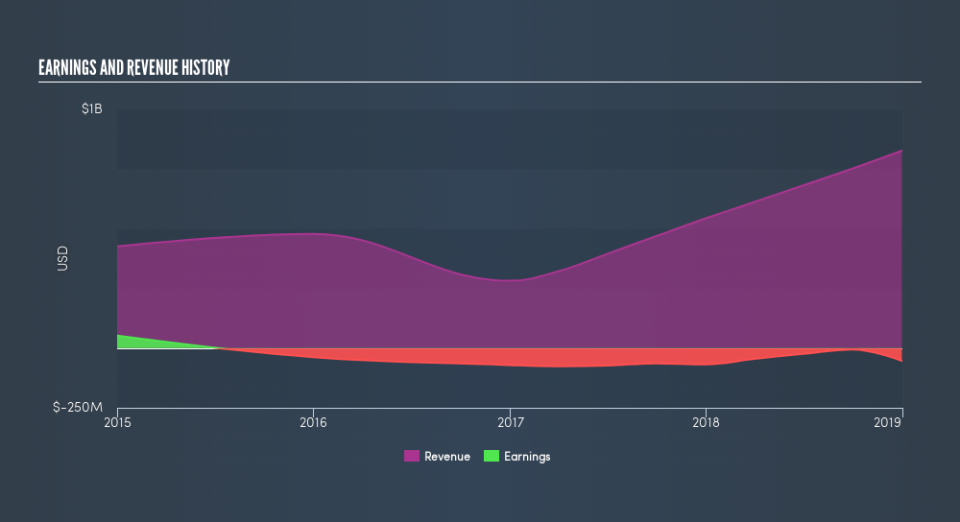

Because Nine Energy Service is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Nine Energy Service grew its revenue by 52% over the last year. That's a strong result which is better than most other loss making companies. Given the revenue growth, the share price drop of 32% seems quite harsh. Our sympathies to shareholders who are now underwater. Prima facie, revenue growth like that should be a good thing, so it's worth checking whether losses have stabilized. Our brains have evolved to think in linear fashion, so there's value in learning to recognize exponential growth. We are, in some ways, simply the wisest of the monkeys.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

This free interactive report on Nine Energy Service's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While Nine Energy Service shareholders are down 32% for the year, the market itself is up 8.2%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. The share price decline has continued throughout the most recent three months, down 14%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. If you would like to research Nine Energy Service in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.