Introducing Redan (WSE:RDN), The Stock That Tanked 85%

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

As an investor, mistakes are inevitable. But you have a problem if you face massive losses more than once in a while. So take a moment to sympathize with the long term shareholders of Redan S.A. (WSE:RDN), who have seen the share price tank a massive 85% over a three year period. That'd be enough to cause even the strongest minds some disquiet. And the ride hasn't got any smoother in recent times over the last year, with the price 64% lower in that time. Furthermore, it's down 37% in about a quarter. That's not much fun for holders.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

Check out our latest analysis for Redan

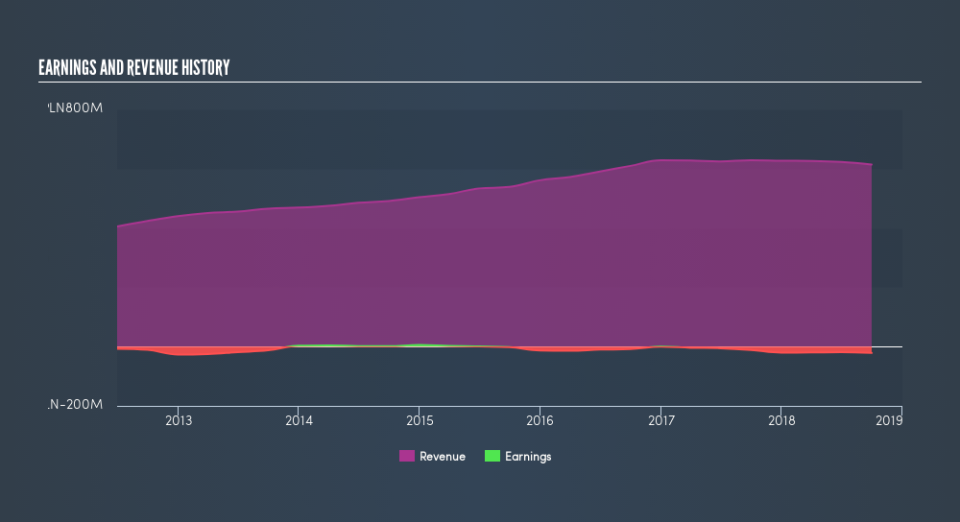

Given that Redan didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over three years, Redan grew revenue at 4.1% per year. Given it's losing money in pursuit of growth, we are not really impressed with that. But the share price crash at 47% per year does seem a bit harsh! We generally don't try to 'catch the falling knife'. Before considering a purchase, take a look at the losses the company is racking up.

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

This free interactive report on Redan's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market lost about 1.7% in the twelve months, Redan shareholders did even worse, losing 64%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 29% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

Of course Redan may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on PL exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.