Introducing Tambla (ASX:TBL), The Stock That Slid 68% In The Last Five Years

We think intelligent long term investing is the way to go. But no-one is immune from buying too high. For example the Tambla Limited (ASX:TBL) share price dropped 68% over five years. That's not a lot of fun for true believers. We also note that the stock has performed poorly over the last year, with the share price down 30%. Furthermore, it's down 21% in about a quarter. That's not much fun for holders.

See our latest analysis for Tambla

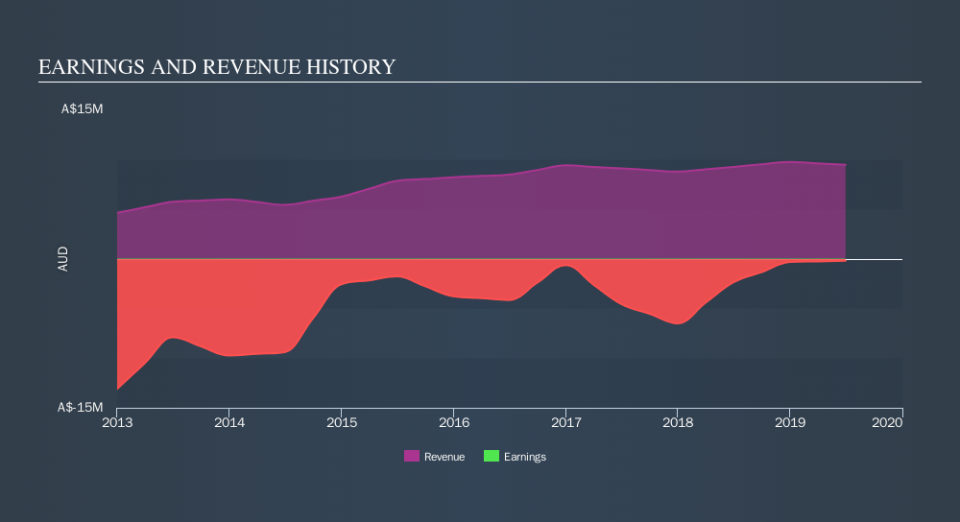

Given that Tambla didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last half decade, Tambla saw its revenue increase by 8.6% per year. That's a fairly respectable growth rate. The share price return isn't so respectable with an annual loss of 20% over the period. It seems probably that the business has failed to live up to initial expectations. That could lead to an opportunity if the company is going to become profitable sooner rather than later.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Investors in Tambla had a tough year, with a total loss of 30%, against a market gain of about 17%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 20% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. If you would like to research Tambla in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.