Introducing TrueCar (NASDAQ:TRUE), The Stock That Dropped 36% In The Last Year

Investors can approximate the average market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. For example, the TrueCar, Inc. (NASDAQ:TRUE) share price is down 36% in the last year. That falls noticeably short of the market return of around 1.4%. The silver lining (for longer term investors) is that the stock is still 22% higher than it was three years ago. The falls have accelerated recently, with the share price down 30% in the last three months. This could be related to the recent financial results – you can catch up on the most recent data by reading our company report.

Check out our latest analysis for TrueCar

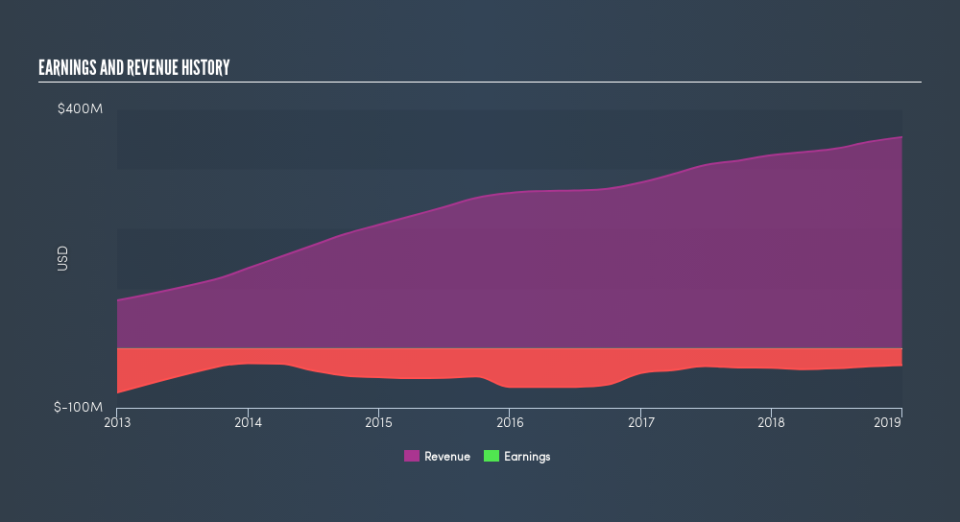

TrueCar isn’t currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn’t make profits, we’d generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last twelve months, TrueCar increased its revenue by 9.4%. While that may seem decent it isn’t great considering the company is still making a loss. Given this lacklustre revenue growth, the share price drop of 36% seems pretty appropriate. It’s important not to lose sight of the fact that profitless companies must grow. But if you buy a loss making company then you could become a loss making investor.

Depicted in the graphic below, you’ll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

TrueCar is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. If you are thinking of buying or selling TrueCar stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

Over the last year, TrueCar shareholders took a loss of 36%. In contrast the market gained about 1.4%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Fortunately the longer term story is brighter, with total returns averaging about 6.8% per year over three years. Sometimes when a good quality long term winner has a weak period, it’s turns out to be an opportunity, but you really need to be sure that the quality is there. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

We will like TrueCar better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.