Introducing Wishbone Gold (LON:WSBN), The Stock That Collapsed 98%

It's not possible to invest over long periods without making some bad investments. But really big losses can really drag down an overall portfolio. So consider, for a moment, the misfortune of Wishbone Gold Plc (LON:WSBN) investors who have held the stock for three years as it declined a whopping 98%. That'd be enough to cause even the strongest minds some disquiet. And over the last year the share price fell 84%, so we doubt many shareholders are delighted. Shareholders have had an even rougher run lately, with the share price down 24% in the last 90 days.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

See our latest analysis for Wishbone Gold

Wishbone Gold wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

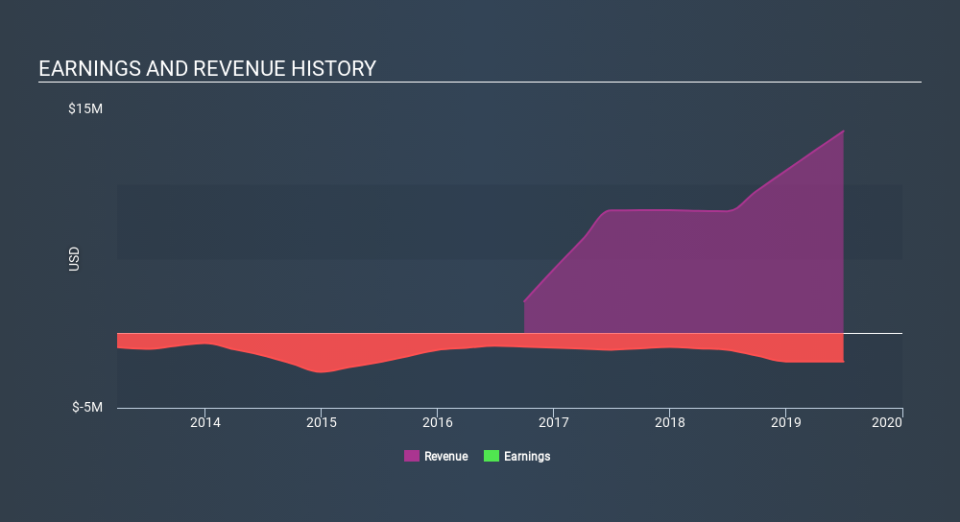

In the last three years, Wishbone Gold saw its revenue grow by 40% per year, compound. That is faster than most pre-profit companies. So on the face of it we're really surprised to see the share price down 71% a year in the same time period. The share price makes us wonder if there is an issue with profitability. Ultimately, revenue growth doesn't amount to much if the business can't scale well. If the company is low on cash, it may have to raise capital soon.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Wishbone Gold's financial health with this free report on its balance sheet.

A Different Perspective

Investors in Wishbone Gold had a tough year, with a total loss of 84%, against a market gain of about 18%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 50% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Be aware that Wishbone Gold is showing 5 warning signs in our investment analysis , and 2 of those are significant...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.