Invesco European Growth Fund Starts 1 Position, Boosts 5 Others in 3rd Quarter

While leaders from the U.K. and the European Union negotiate a new Brexit deal this week, the Invesco European Growth Fund (Trades, Portfolio) disclosed it established one new holding in Icon PLC (NASDAQ:ICLR) and boosted five existing positions during the third quarter: Bureau Veritas SA (XPAR:BVI), SAP SE (NYSE:SAP)(XTER:SAP), Phillip Morris International Inc. (NYSE:PM), Alcon Inc. (XSWX:ALC) and FinecoBank SpA (MIL:FBK).

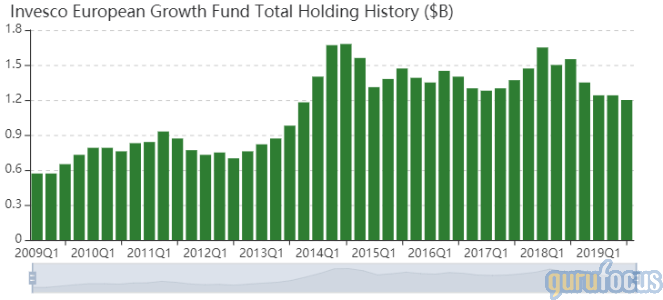

The fund seeks exposure to high-quality growth opportunities in the European region, in both developed and developing markets. As of quarter-end, the fund's $1.20 billion equity portfolio contains 57 stocks, with a turnover ratio of 3%. The top three sectors in terms of weight are financial services, industrials and consumer cyclical, with weights of 25.09%, 20.74% and 17.06%.

U.K. and EU reach new Brexit deal, but opposition remains

The fund managers said in their June quarterly letter that several geopolitical issues, which included the U.S.-China trade war and disagreements between the U.K. and the EU regarding Brexit, rattled markets during the second quarter.

On Thursday, U.K. Prime Minister Boris Johnson said in a tweet that the two regions "got a great new deal that takes back control" and that Parliament should sign the deal and get Brexit done this Saturday. European Commission President Jean-Claude Juncker added in his tweet that the deal is "fair and balanced" and a "testament to [the two regions'] commitment to find solutions." Juncker recommends that the Commission endorses the deal.

Despite Johnson and Juncker's comments, opposition parties still denounced the deal, saying it was worse than that of former Prime Minister Theresa May's deal. Parliament members voted "no deal" thrice to May's offer primarily due to objections regarding the "Irish backstop" issue.

The U.K. parliament will vote "deal or no deal" on Johnson's offer on Saturday, less than two weeks until the departure day of Oct. 31.

Fund starts new position in Irish medial research company

The fund purchased 56,077 shares of Icon, giving the position 0.73% weight in the equity portfolio. Shares averaged $146.47 during the quarter.

The Dublin-based company provides drug development and clinical testing services to pharmaceutical, biotechnology and medial device companies. Icon mentioned several risks in its 2018 annual report filing, including geopolitical risks. The company said because Icon employs approximately 700 people in the U.K. and has approximately 3% of revenue billed in pounds, Brexit might impact its financial position.

GuruFocus ranks Icon's profitability 8 out of 10 on several positive investing signs, which include expanding profit margins and returns that are outperforming over 89% of global competitors. Despite this, gross margins have contracted approximately 2.5% per year on average over the past five years.

Other gurus with holdings in Icon include Ron Baron (Trades, Portfolio), Steven Cohen (Trades, Portfolio) and Jim Simons (Trades, Portfolio)' Renaissance Technologies.

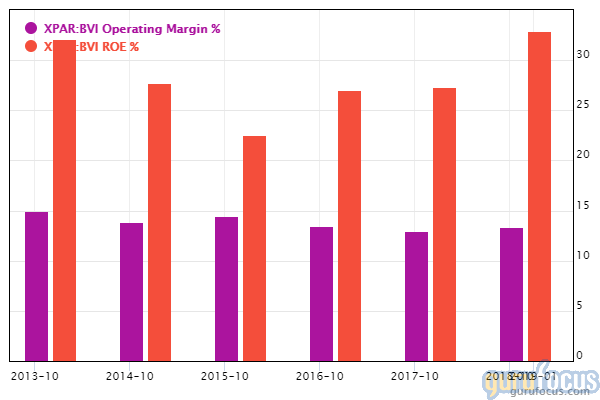

Bureau Veritas

Having purchased 667,763 shares of Bureau Veritas during the second quarter, the fund added 255,923 shares in the third quarter, increasing the position 38.33% and the equity portfolio 0.53%. Shares averaged 21.03 euros ($23.40) during the second quarter and 21.67 euros during the third quarter. Based on GuruFocus estimates, the fund has a 2.70% gain on the stock since initiating the position during the June quarter.

The French business services company tests products, inspects sites and equipment and certifies products to maintain global standards. GuruFocus ranks the company's profitability 8 out of 10 on several positive investing signs, which include a strong Piotroski F-score of 8 and a return on equity that outperforms 94.21% of global competitors.

SAP

The fund added 51,534 shares of SAP, increasing the position 25.64% and the equity portfolio 0.53%. Shares averaged 115.4 euros during the quarter.

GuruFocus ranks the German software vendor's profitability 9 out of 10 on the heels of consistent revenue growth and operating margins that are outperforming 87.80% of global competitors despite contracting approximately 4% per year on average over the past five years. The website gives SAP the business predictability rank of four stars.

Spiros Segalas (Trades, Portfolio) purchased 2,180,859 American depository receipt shares of SAP during the quarter, with shares averaging $129.59.

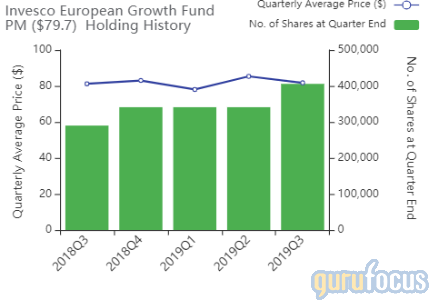

Phillip Morris

The fund purchased 64,844 shares of Phillip Morris, increasing the position 19.01% and the equity portfolio 0.45%. Shares averaged $81.77 during the quarter.

GuruFocus ranks the New York-based tobacco company's profitability 8 out of 10 on several positive investing signs, which include operating margins that are outperforming 88.57% of global competitors despite declining over the past five years. Additionally, Phillip Morris' Joel Greenblatt (Trades, Portfolio) return on capital outperforms 80.56% of global tobacco manufacturers.

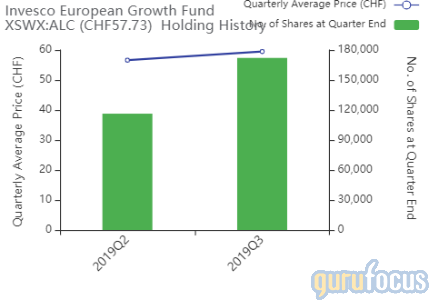

Alcon

The fund added 55,744 shares of Alcon, increasing the position 47.92% and the equity portfolio 0.27%. Shares averaged 59.5 Swiss francs ($60.22) during the quarter.

According to GuruFocus, the Swiss medial equipment company has an equity-to-asset ratio of 0.72 and a debt-to-equity ratio of 0.18, both outperforming over 60% of global competitors. Despite this, Alcon's cash-to-debt ratio of 0.14 underperforms 83.57% of global medical equipment companies.

FinecoBank

The fund added 196,465 shares of FinecoBank, increasing the position 11.21% and the equity portfolio 0.16%. Shares averaged 9.79 euros during the quarter.

According to GuruFocus, the Italian bank's cash-to-debt ratio of 25.02 and debt-to-equity ratio of 0.08 both outperform over 87% of global competitors, suggesting good financial strength.

Disclosure: No positions.

Read more here:

Third Avenue Value Fund's Top 5 Buys in the 3rd Quarter

T Rowe Price Equity Income Fund's Top 5 Buys in the 3rd Quarter

Steven Romick Buys 3 Stocks in 3rd Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.