Investing in Academy Sports and Outdoors (NASDAQ:ASO) a year ago would have delivered you a 55% gain

Academy Sports and Outdoors, Inc. (NASDAQ:ASO) shareholders might be concerned after seeing the share price drop 12% in the last quarter. While that might be a setback, it doesn't negate the nice returns received over the last twelve months. To wit, it had solidly beat the market, up 55%.

Let's take a look at the underlying fundamentals over the longer term, and see if they've been consistent with shareholders returns.

View our latest analysis for Academy Sports and Outdoors

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

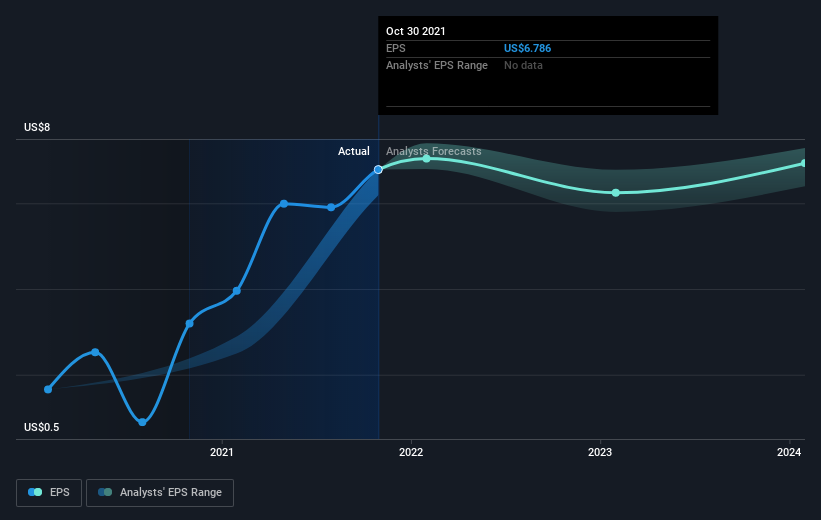

During the last year Academy Sports and Outdoors grew its earnings per share (EPS) by 114%. This EPS growth is significantly higher than the 55% increase in the share price. So it seems like the market has cooled on Academy Sports and Outdoors, despite the growth. Interesting. The caution is also evident in the lowish P/E ratio of 5.38.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. Dive deeper into the earnings by checking this interactive graph of Academy Sports and Outdoors' earnings, revenue and cash flow.

A Different Perspective

It's nice to see that Academy Sports and Outdoors shareholders have gained 55% over the last year. Unfortunately the share price is down 12% over the last quarter. Shorter term share price moves often don't signify much about the business itself. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 1 warning sign for Academy Sports and Outdoors you should be aware of.

Academy Sports and Outdoors is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.