Investment Managers' Earnings on Jan 29: IVZ, LM, TROW & More

Performance of investment managers (part of the broader Finance sector), over the past several quarters, has been volatile due to a tough operating backdrop. Nonetheless, this time, the trend is likely to get reversed with support from solid equity markets performance.

Assets under management (AUM) are likely to have increased, driven by shifting focus on passive investment strategies. Rise in operating expenses, on account of marketing initiatives and investments in technology, might have impeded bottom-line growth.

Some investment managers, including BlackRock, Inc. BLK, have already come out with results. The company witnessed year-over-year rise in earnings owing to higher revenues.

Per our Earnings Outlook, overall earnings for the finance sector for the quarter are expected to be up 12.6% year over year. This compares favorably with the prior-quarter growth of 3.2%.

Let’s take a look at the investment management stocks that are slated to report on Jan 29.

Invesco IVZ is scheduled to report fourth-quarter and 2019 results, before the opening bell. Our proven model predicts an earnings beat for the company this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat.

Invesco has a Zacks Rank #2 and Earnings ESP of +1.39%.

(You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.)

Invesco’s total AUM is likely to have increased, majorly driven by net inflows. The Zacks Consensus Estimate for average AUM of $1,216 billion indicates a rise of 3.4% from the prior-quarter reported figure. So, performance fees and investment management fees are likely to have recorded moderate growth in the fourth quarter. (Read more: Rise in Assets Balance to Support Invesco Q4 Earnings)

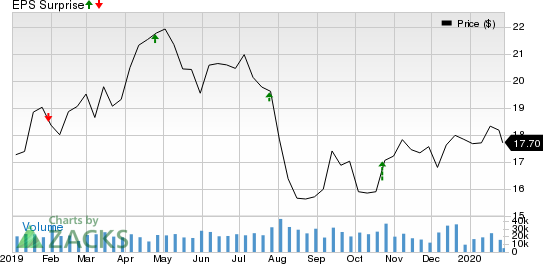

Invesco has a decent earnings surprise history. Its earnings surpassed the Zacks Consensus Estimate in three of the trailing four quarters, as shown in the chart below:

Invesco Ltd. Price and EPS Surprise

Invesco Ltd. price-eps-surprise | Invesco Ltd. Quote

Legg Mason LM is slated to announce third-quarter fiscal 2020 results, after market close. Higher performance and investment management fees, favorable foreign-currency fluctuations, and muted growth in advisory and net inflows in fixed income are likely to have supported the company’s performance. (Read more: Can Higher Assets Support Legg Mason's Q3 Earnings?)

Further, chances of Legg Mason beating the Zacks Consensus Estimate are high this time as it has an Earnings ESP of +1.59% and Zacks Rank #2.

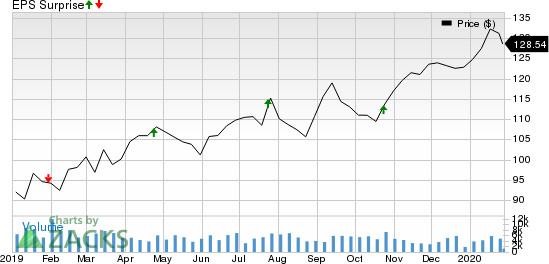

The company has an impressive earnings surprise history. It surpassed the Zacks Consensus Estimate in each of the trailing four quarters.

Legg Mason, Inc. Price and EPS Surprise

Legg Mason, Inc. price-eps-surprise | Legg Mason, Inc. Quote

T. Rowe Price Group TROW, scheduled to report fourth-quarter 2019 results before the opening bell, is likely to have witnessed net inflows and thus, total AUM might have recorded a rise. The Zacks Consensus Estimate for AUM is pegged at $1.18 billion, which indicates 4.4% rise from the previous quarter.

It has a Zacks Rank #2 and an Earnings ESP of +1.47%. (Read more: Strong Equity Markets to Aid T. Rowe Price Q4 Earnings)

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

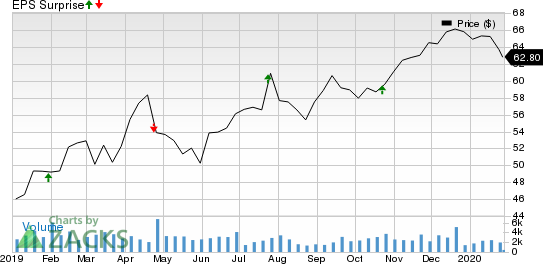

T. Rowe has a decent earnings surprise history. The company surpassed the Zacks Consensus Estimate in three of the trailing four quarters.

T. Rowe Price Group, Inc. Price and EPS Surprise

T. Rowe Price Group, Inc. price-eps-surprise | T. Rowe Price Group, Inc. Quote

Ameriprise Financial AMP is scheduled to report fourth-quarter and 2019 results after market close. Based on expectations of improved advisor productivity, the Advice & Wealth Management segment is likely to have recorded growth in assets. Operating expenses are expected to have increased in the to-be-reported quarter due to advertising campaign and technology upgrades.

It has a Zacks Rank #2 and an Earnings ESP of +0.39%. (Read more: Ameriprise to Post Q4 Earnings: Is a Beat in Store?)

The company has an impressive earnings surprise history, having surpassed the Zacks Consensus Estimate in each of the trailing four quarters, as shown in the chart below:

Ameriprise Financial, Inc. Price and EPS Surprise

Ameriprise Financial, Inc. price-eps-surprise | Ameriprise Financial, Inc. Quote

SEI Investments Company SEIC is slated to announce fourth-quarter 2019 results after market close. The company is expected to have to recorded an increase in revenues and earnings in the to-be-reported quarter.

The Zacks Consensus Estimate for earnings of 85 cents reflects a year-over-year rise of 16.4%. The consensus estimate for sales of $421.2 million suggests an increase of 4%. It has a Zacks Rank #1 and an Earnings ESP of +2.35%.

SEI Investments has a decent earnings surprise history. The company surpassed the Zacks Consensus Estimate in two of the trailing four quarters.

SEI Investments Company Price and EPS Surprise

SEI Investments Company price-eps-surprise | SEI Investments Company Quote

Check back later for our full write-up on earnings releases of these stocks.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Legg Mason, Inc. (LM) : Free Stock Analysis Report

Invesco Ltd. (IVZ) : Free Stock Analysis Report

SEI Investments Company (SEIC) : Free Stock Analysis Report

BlackRock, Inc. (BLK) : Free Stock Analysis Report

Ameriprise Financial, Inc. (AMP) : Free Stock Analysis Report

T. Rowe Price Group, Inc. (TROW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research