Investor Optimism Abounds Packaging Corporation of America (NYSE:PKG) But Growth Is Lacking

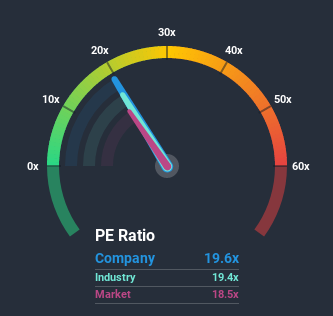

With a median price-to-earnings (or "P/E") ratio of close to 18x in the United States, you could be forgiven for feeling indifferent about Packaging Corporation of America's (NYSE:PKG) P/E ratio of 19.6x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Packaging Corporation of America has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is moderate because investors think the company's earnings trend will eventually fall in line with most others in the market. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

Check out our latest analysis for Packaging Corporation of America

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Packaging Corporation of America.

Is There Some Growth For Packaging Corporation of America?

The only time you'd be comfortable seeing a P/E like Packaging Corporation of America's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered a frustrating 35% decrease to the company's bottom line. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 2.8% per annum over the next three years. With the market predicted to deliver 13% growth per annum, the company is positioned for a weaker earnings result.

In light of this, it's curious that Packaging Corporation of America's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Bottom Line On Packaging Corporation of America's P/E

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Packaging Corporation of America's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Packaging Corporation of America that you need to be mindful of.

If these risks are making you reconsider your opinion on Packaging Corporation of America, explore our interactive list of high quality stocks to get an idea of what else is out there.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.