Investors bid Sea (NYSE:SE) up US$2.0b despite increasing losses YoY, taking five-year CAGR to 48%

We think all investors should try to buy and hold high quality multi-year winners. While not every stock performs well, when investors win, they can win big. To wit, the Sea Limited (NYSE:SE) share price has soared 613% over five years. If that doesn't get you thinking about long term investing, we don't know what will. It's also good to see the share price up 54% over the last quarter. The company reported its financial results recently; you can catch up on the latest numbers by reading our company report. It really delights us to see such great share price performance for investors.

Since it's been a strong week for Sea shareholders, let's have a look at trend of the longer term fundamentals.

Check out our latest analysis for Sea

Sea isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last 5 years Sea saw its revenue grow at 56% per year. That's well above most pre-profit companies. Arguably, this is well and truly reflected in the strong share price gain of 48%(per year) over the same period. Despite the strong run, top performers like Sea have been known to go on winning for decades. So we'd recommend you take a closer look at this one, but keep in mind the market seems optimistic.

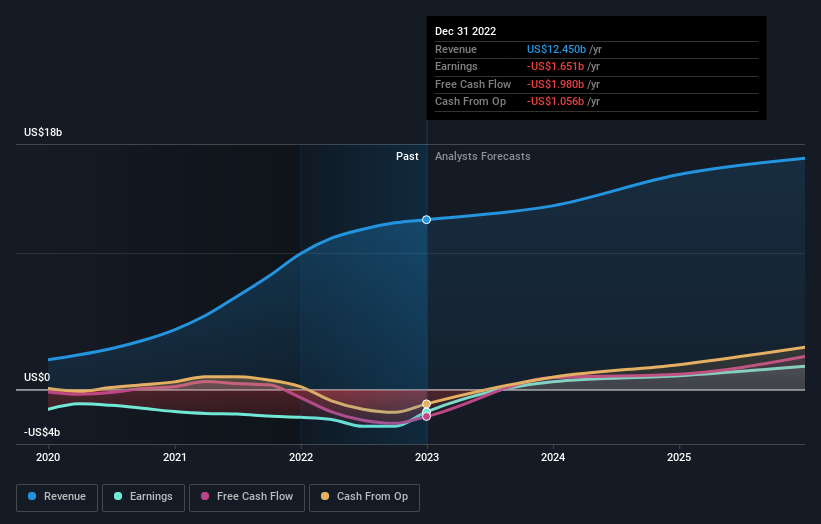

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Sea is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. You can see what analysts are predicting for Sea in this interactive graph of future profit estimates.

A Different Perspective

While the broader market lost about 12% in the twelve months, Sea shareholders did even worse, losing 31%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 48%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here