Investors Who Bought Amalgamated Bank (NASDAQ:AMAL) Shares A Year Ago Are Now Down 17%

The simplest way to benefit from a rising market is to buy an index fund. But if you buy individual stocks, you can do both better or worse than that. Investors in Amalgamated Bank (NASDAQ:AMAL) have tasted that bitter downside in the last year, as the share price dropped 17%. That contrasts poorly with the market return of 3.7%. Amalgamated Bank may have better days ahead, of course; we've only looked at a one year period. It's up 1.6% in the last seven days.

See our latest analysis for Amalgamated Bank

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Even though the Amalgamated Bank share price is down over the year, its EPS actually improved. It could be that the share price was previously over-hyped.

The divergence between the EPS and the share price is quite notable, during the year. But we might find some different metrics explain the share price movements better.

With a low yield of 1.5% we doubt that the dividend influences the share price much. Amalgamated Bank's revenue is actually up 16% over the last year. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

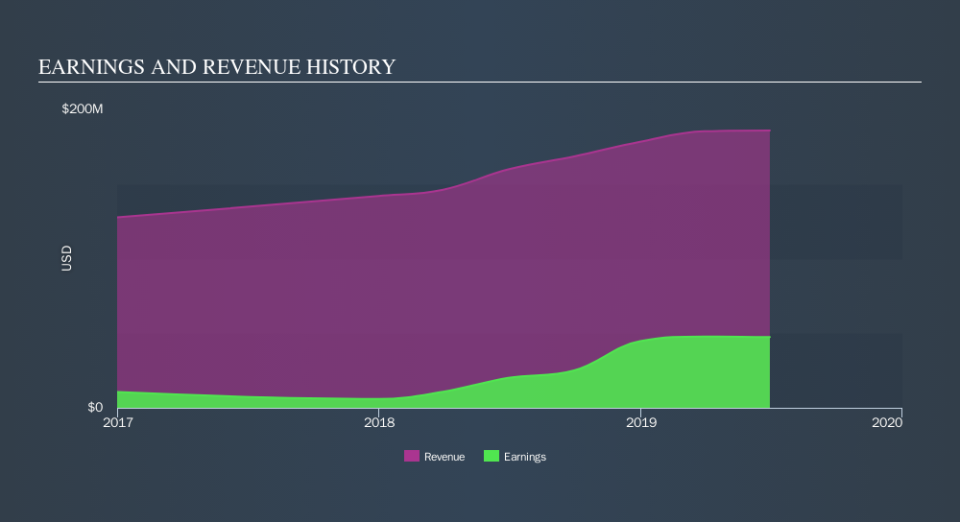

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We know that Amalgamated Bank has improved its bottom line over the last three years, but what does the future have in store? It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

While Amalgamated Bank shareholders are down 16% for the year (even including dividends) , the market itself is up 3.7%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. The share price decline has continued throughout the most recent three months, down 8.3%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. If you would like to research Amalgamated Bank in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.