Investors Who Bought Aptitude Software Group (LON:APTD) Shares Three Years Ago Are Now Up 215%

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But if you buy shares in a really great company, you can more than double your money. For instance the Aptitude Software Group plc (LON:APTD) share price is 215% higher than it was three years ago. That sort of return is as solid as granite. It's also good to see the share price up 18% over the last quarter.

See our latest analysis for Aptitude Software Group

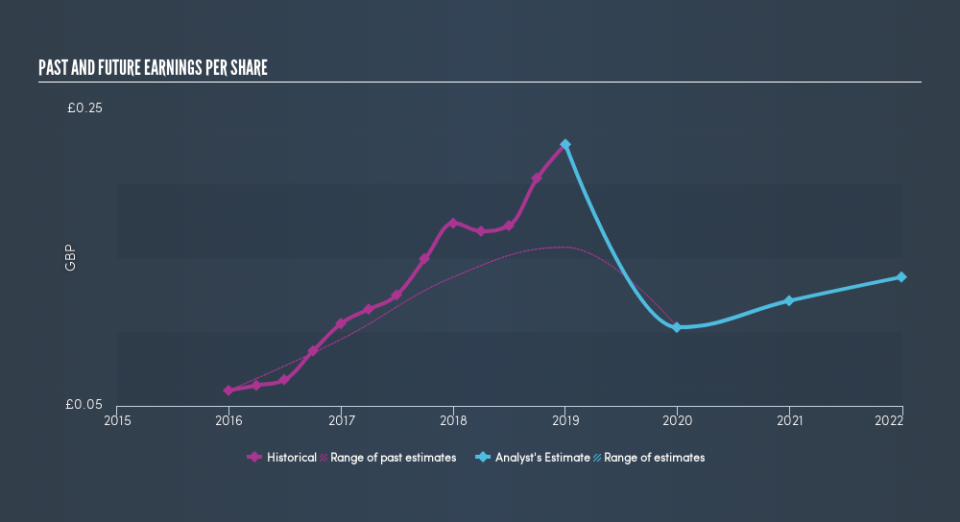

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During three years of share price growth, Aptitude Software Group achieved compound earnings per share growth of 55% per year. We don't think it is entirely coincidental that the EPS growth is reasonably close to the 47% average annual increase in the share price. This observation indicates that the market's attitude to the business hasn't changed all that much. Quite to the contrary, the share price has arguably reflected the EPS growth.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It is of course excellent to see how Aptitude Software Group has grown profits over the years, but the future is more important for shareholders. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Aptitude Software Group the TSR over the last 3 years was 231%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's nice to see that Aptitude Software Group shareholders have received a total shareholder return of 25% over the last year. And that does include the dividend. However, that falls short of the 35% TSR per annum it has made for shareholders, each year, over five years. Before forming an opinion on Aptitude Software Group you might want to consider these 3 valuation metrics.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.