Investors Who Bought Blue Capital Reinsurance Holdings (NYSE:BCRH) Shares Five Years Ago Are Now Down 66%

The main aim of stock picking is to find the market-beating stocks. But every investor is virtually certain to have both over-performing and under-performing stocks. At this point some shareholders may be questioning their investment in Blue Capital Reinsurance Holdings Ltd. (NYSE:BCRH), since the last five years saw the share price fall 66%. And we doubt long term believers are the only worried holders, since the stock price has declined 45% over the last twelve months. The falls have accelerated recently, with the share price down 12% in the last three months. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

View our latest analysis for Blue Capital Reinsurance Holdings

Blue Capital Reinsurance Holdings isn’t currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That’s because it’s hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

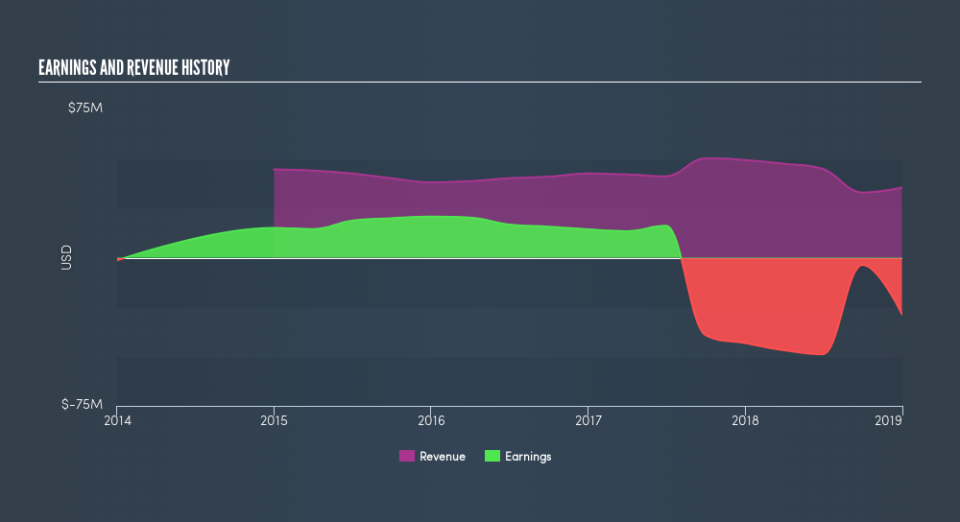

Depicted in the graphic below, you’ll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

It’s probably worth noting that the CEO is paid less than the median at similar sized companies. It’s always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. So it makes a lot of sense to check out what analysts think Blue Capital Reinsurance Holdings will earn in the future (free profit forecasts)

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Blue Capital Reinsurance Holdings the TSR over the last 5 years was -48%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Blue Capital Reinsurance Holdings shareholders are down 40% for the year (even including dividends), but the market itself is up 3.1%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year’s performance caps off a bad run, with the shareholders facing a total loss of 12% per year over five years. We realise that Buffett has said investors should ‘buy when there is blood on the streets’, but we caution that investors should first be sure they are buying a high quality businesses. Keeping this in mind, a solid next step might be to take a look at Blue Capital Reinsurance Holdings’s dividend track record. This free interactive graph is a great place to start.

If you would prefer to check out another company — one with potentially superior financials — then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.