Investors Who Bought Dillard's (NYSE:DDS) Shares Five Years Ago Are Now Down 32%

The main aim of stock picking is to find the market-beating stocks. But the main game is to find enough winners to more than offset the losers So we wouldn't blame long term Dillard's, Inc. (NYSE:DDS) shareholders for doubting their decision to hold, with the stock down 32% over a half decade. On the other hand, we note it's up 9.6% in about a month.

See our latest analysis for Dillard's

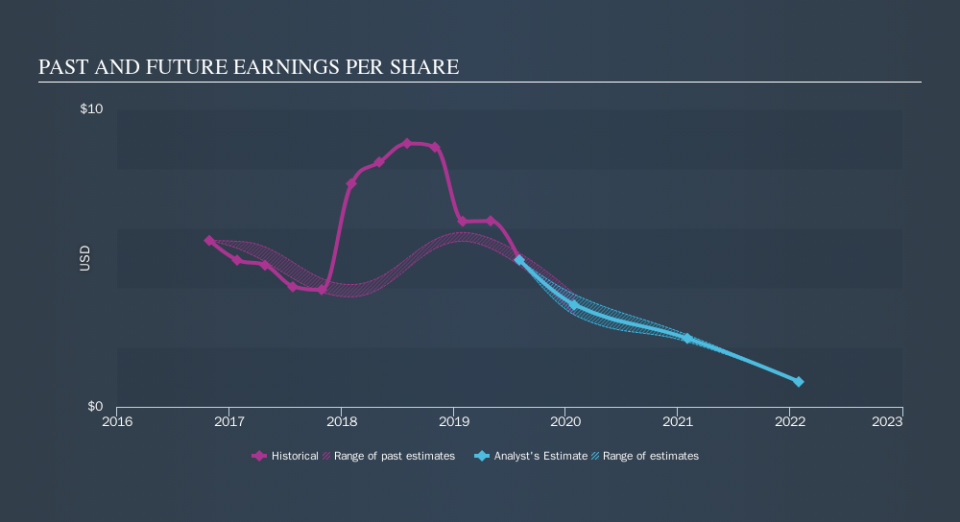

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Looking back five years, both Dillard's's share price and EPS declined; the latter at a rate of 7.2% per year. This change in EPS is remarkably close to the 7.5% average annual decrease in the share price. This implies that the market has had a fairly steady view of the stock. Rather, the share price change has reflected changes in earnings per share.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

Dillard's shareholders are down 7.0% for the year (even including dividends) , but the market itself is up 3.7%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 7.0% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. If you would like to research Dillard's in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

We will like Dillard's better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.