Investors Who Bought ENGlobal (NASDAQ:ENG) Shares Three Years Ago Are Now Down 66%

Investing in stocks inevitably means buying into some companies that perform poorly. But long term ENGlobal Corporation (NASDAQ:ENG) shareholders have had a particularly rough ride in the last three year. Sadly for them, the share price is down 66% in that time. Shareholders have had an even rougher run lately, with the share price down 19% in the last 90 days.

Check out our latest analysis for ENGlobal

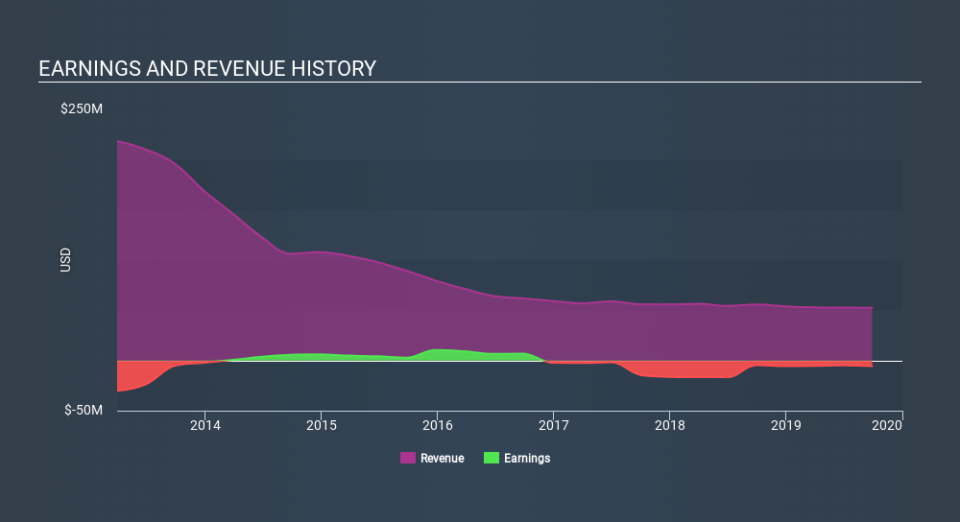

ENGlobal isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last three years, ENGlobal's revenue dropped 4.8% per year. That is not a good result. The share price decline of 30% compound, over three years, is understandable given the company doesn't have profits to boast of, and revenue is moving in the wrong direction. Of course, it's the future that will determine whether today's price is a good one. We don't generally like to own companies that lose money and can't grow revenues. But any company is worth looking at when it makes a maiden profit.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of ENGlobal's earnings, revenue and cash flow.

A Different Perspective

ENGlobal shareholders gained a total return of 19% during the year. But that return falls short of the market. But at least that's still a gain! Over five years the TSR has been a reduction of 12% per year, over five years. So this might be a sign the business has turned its fortunes around. It's always interesting to track share price performance over the longer term. But to understand ENGlobal better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with ENGlobal (at least 1 which doesn't sit too well with us) , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.