Investors Who Bought Ensurance (ASX:ENA) Shares Three Years Ago Are Now Down 88%

It's not possible to invest over long periods without making some bad investments. But you have a problem if you face massive losses more than once in a while. So consider, for a moment, the misfortune of Ensurance Limited (ASX:ENA) investors who have held the stock for three years as it declined a whopping 88%. That might cause some serious doubts about the merits of the initial decision to buy the stock, to put it mildly. And over the last year the share price fell 43%, so we doubt many shareholders are delighted. There was little comfort for shareholders in the last week as the price declined a further 9.1%.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

See our latest analysis for Ensurance

Because Ensurance is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

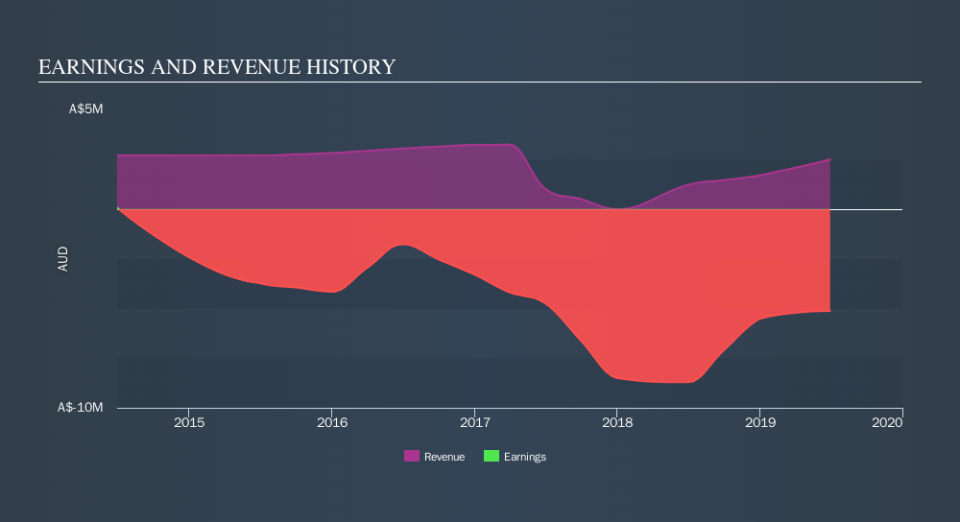

In the last three years Ensurance saw its revenue shrink by 26% per year. That means its revenue trend is very weak compared to other loss making companies. The swift share price decline at an annual compound rate of 50%, reflects this weak fundamental performance. We prefer leave it to clowns to try to catch falling knives, like this stock. There is a good reason that investors often describe buying a sharply falling stock price as 'trying to catch a falling knife'. Think about it.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. This free interactive report on Ensurance's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Over the last year, Ensurance shareholders took a loss of 43%. In contrast the market gained about 13%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. Unfortunately, the longer term story isn't pretty, with investment losses running at 48% per year over three years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

Ensurance is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.