Investors Who Bought EssilorLuxottica Société anonyme (EPA:EL) Shares Five Years Ago Are Now Up 64%

When we invest, we're generally looking for stocks that outperform the market average. And while active stock picking involves risks (and requires diversification) it can also provide excess returns. For example, the EssilorLuxottica Société anonyme (EPA:EL) share price is up 64% in the last 5 years, clearly besting than the market return of around 30% (ignoring dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 8.1% in the last year, including dividends.

See our latest analysis for EssilorLuxottica Société anonyme

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

EssilorLuxottica Société anonyme's earnings per share are down 6.4% per year, despite strong share price performance over five years. Essentially, it doesn't seem likely that investors are focused on EPS. Because earnings per share don't seem to match up with the share price, we'll take a look at other metrics instead.

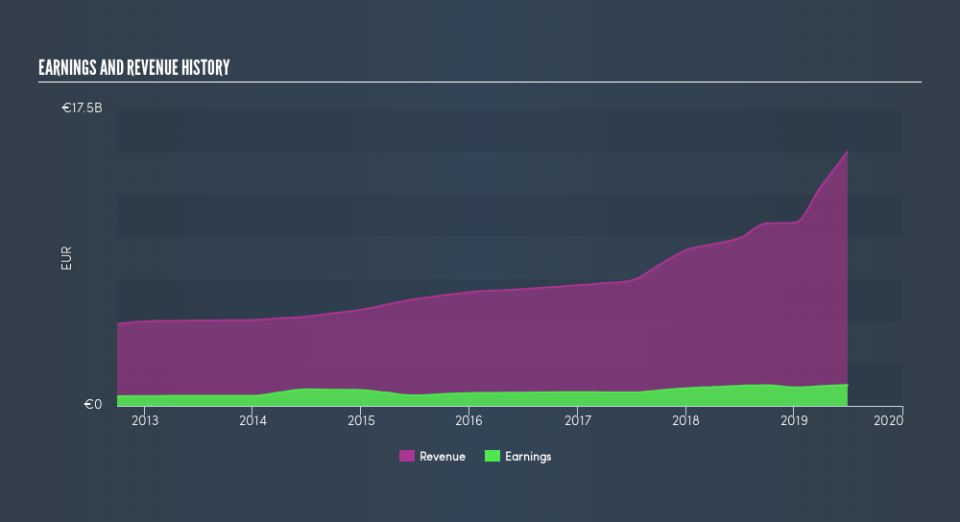

The modest 1.5% dividend yield is unlikely to be propping up the share price. On the other hand, EssilorLuxottica Société anonyme's revenue is growing nicely, at a compound rate of 19% over the last five years. It's quite possible that management are prioritizing revenue growth over EPS growth at the moment.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

EssilorLuxottica Société anonyme is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of EssilorLuxottica Société anonyme, it has a TSR of 75% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We're pleased to report that EssilorLuxottica Société anonyme shareholders have received a total shareholder return of 8.1% over one year. And that does include the dividend. However, the TSR over five years, coming in at 12% per year, is even more impressive. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. Before deciding if you like the current share price, check how EssilorLuxottica Société anonyme scores on these 3 valuation metrics.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.