Investors Who Bought Johnson Electric Holdings Shares A Year Ago Are Now Down 37%

The simplest way to benefit from a rising market is to buy an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. Investors in Johnson Electric Holdings Limited (HKG:179) have tasted that bitter downside in the last year, as the share price dropped 37%. That’s well bellow the market return of -3.3%. Longer term shareholders haven’t suffered as badly, since the stock is down a comparatively less painful 17% in three years. Unhappily, the share price slid 1.0% in the last week.

See our latest analysis for Johnson Electric Holdings

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it’s a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the unfortunate twelve months during which the Johnson Electric Holdings share price fell, it actually saw its earnings per share (EPS) improve by 2.0%. It could be that the share price was previously over-hyped. By glancing at these numbers, we’d posit that the the market had expectations of much higher growth, last year. But other metrics might shed some light on why the share price is down.

Johnson Electric Holdings managed to grow revenue over the last year, which is usually a real positive. Since the fundamental metrics don’t readily explain the share price drop, there might be an opportunity if the market has overreacted.

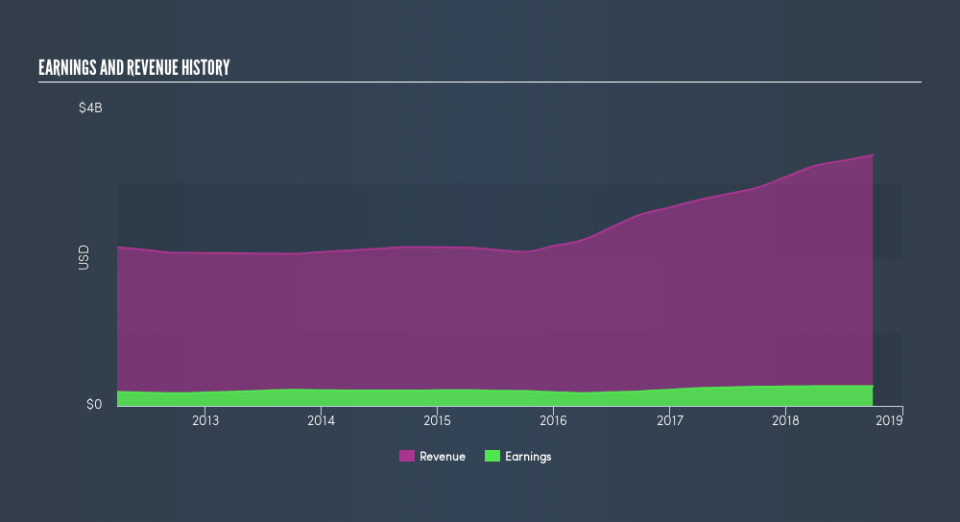

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

It’s good to see that there was some significant insider buying in the last three months. That’s a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. This free report showing analyst forecasts should help you form a view on Johnson Electric Holdings

What about the Total Shareholder Return (TSR)?

We’d be remiss not to mention the difference between Johnson Electric Holdings’s total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Johnson Electric Holdings shareholders, and that cash payout explains why its total shareholder loss of 35%, over the last year, isn’t as bad as the share price return.

A Different Perspective

We regret to report that Johnson Electric Holdings shareholders are down 35% for the year (even including dividends). Unfortunately, that’s worse than the broader market decline of 3.3%. Having said that, it’s inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year’s performance may indicate unresolved challenges, given that it was worse than the annualised loss of 6.5% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Johnson Electric Holdings by clicking this link.

Johnson Electric Holdings is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.