Investors Who Bought PDC Energy (NASDAQ:PDCE) Shares Three Years Ago Are Now Down 71%

As an investor, mistakes are inevitable. But you have a problem if you face massive losses more than once in a while. So spare a thought for the long term shareholders of PDC Energy, Inc. (NASDAQ:PDCE); the share price is down a whopping 71% in the last three years. That would certainly shake our confidence in the decision to own the stock. And over the last year the share price fell 30%, so we doubt many shareholders are delighted. Shareholders have had an even rougher run lately, with the share price down 25% in the last 90 days.

Check out our latest analysis for PDC Energy

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

PDC Energy became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. So given the share price is down it's worth checking some other metrics too.

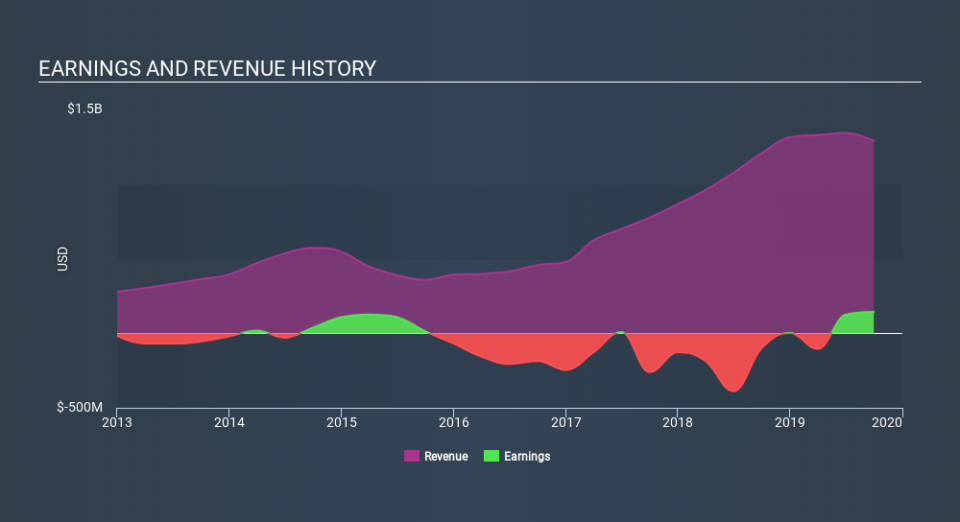

Revenue is actually up 35% over the three years, so the share price drop doesn't seem to hinge on revenue, either. It's probably worth investigating PDC Energy further; while we may be missing something on this analysis, there might also be an opportunity.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So it makes a lot of sense to check out what analysts think PDC Energy will earn in the future (free profit forecasts).

A Different Perspective

While the broader market gained around 20% in the last year, PDC Energy shareholders lost 30%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 7.2% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.