Investors Who Bought Premier Gold Mines (TSE:PG) Shares Three Years Ago Are Now Down 52%

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

The truth is that if you invest for long enough, you're going to end up with some losing stocks. Long term Premier Gold Mines Limited (TSE:PG) shareholders know that all too well, since the share price is down considerably over three years. So they might be feeling emotional about the 52% share price collapse, in that time. And the ride hasn't got any smoother in recent times over the last year, with the price 46% lower in that time. There was little comfort for shareholders in the last week as the price declined a further 4.8%.

Check out our latest analysis for Premier Gold Mines

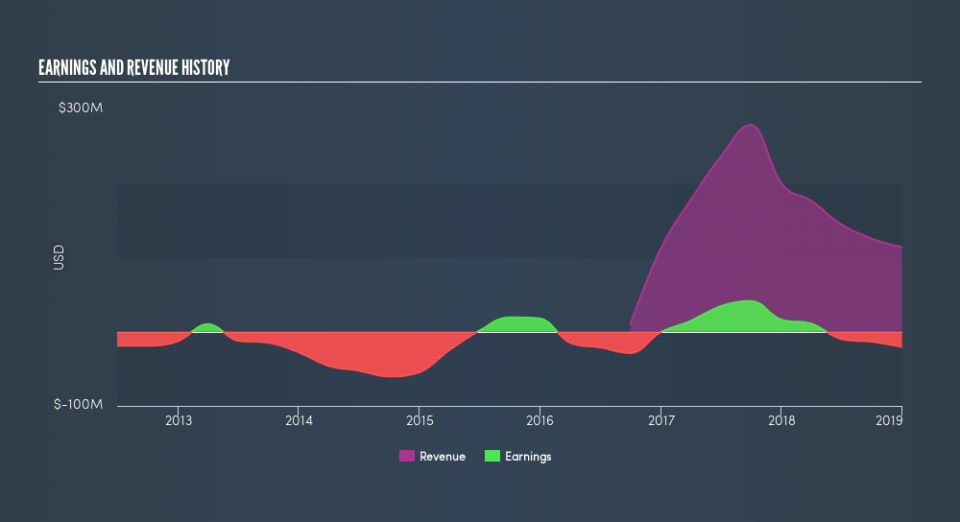

Given that Premier Gold Mines didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. So it makes a lot of sense to check out what analysts think Premier Gold Mines will earn in the future (free profit forecasts).

A Different Perspective

Investors in Premier Gold Mines had a tough year, with a total loss of 46%, against a market gain of about 4.6%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 4.9% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

Premier Gold Mines is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.