Investors Who Bought SailPoint Technologies Holdings (NYSE:SAIL) Shares A Year Ago Are Now Down 24%

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. But if you buy individual stocks, you can do both better or worse than that. Unfortunately the SailPoint Technologies Holdings, Inc. (NYSE:SAIL) share price slid 24% over twelve months. That's disappointing when you consider the market returned 6.1%. We wouldn't rush to judgement on SailPoint Technologies Holdings because we don't have a long term history to look at. The share price has dropped 24% in three months.

View our latest analysis for SailPoint Technologies Holdings

SailPoint Technologies Holdings isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last twelve months, SailPoint Technologies Holdings increased its revenue by 31%. We think that is pretty nice growth. Meanwhile, the share price is down 24% over twelve months, which is disappointing given the progress made. This implies the market was expecting better growth. However, that's in the past now, and it's the future that matters most.

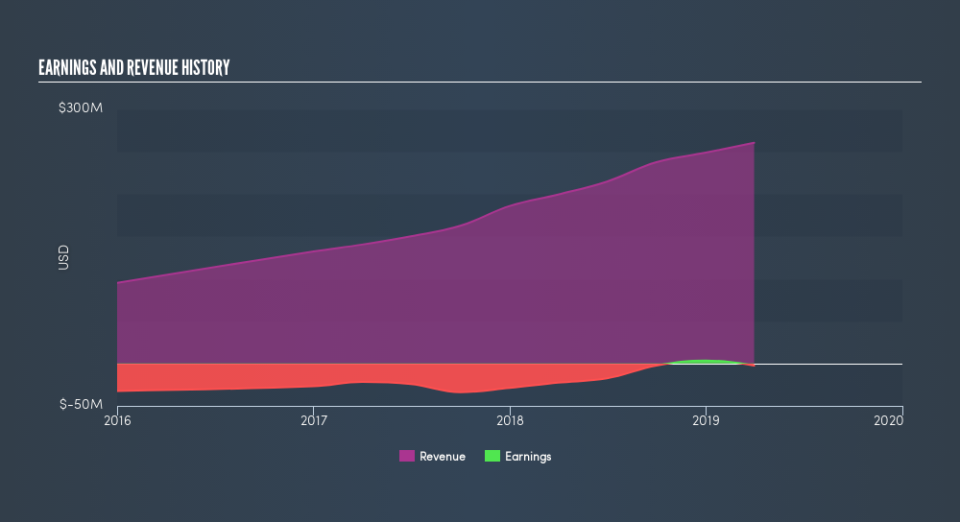

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. If you are thinking of buying or selling SailPoint Technologies Holdings stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

Given that the market gained 6.1% in the last year, SailPoint Technologies Holdings shareholders might be miffed that they lost 24%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. It's worth noting that the last three months did the real damage, with a 24% decline. So it seems like some holders have been dumping the stock of late - and that's not bullish. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

We will like SailPoint Technologies Holdings better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.