Investors Who Bought New Silkroad Culturaltainment (HKG:472) Shares Three Years Ago Are Now Down 70%

While not a mind-blowing move, it is good to see that the New Silkroad Culturaltainment Limited (HKG:472) share price has gained 29% in the last three months. But only the myopic could ignore the astounding decline over three years. In that time the share price has melted like a snowball in the desert, down 70%. So it sure is nice to see a big of an improvement. Only time will tell if the company can sustain the turnaround.

Check out our latest analysis for New Silkroad Culturaltainment

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

New Silkroad Culturaltainment became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. So given the share price is down it's worth checking some other metrics too.

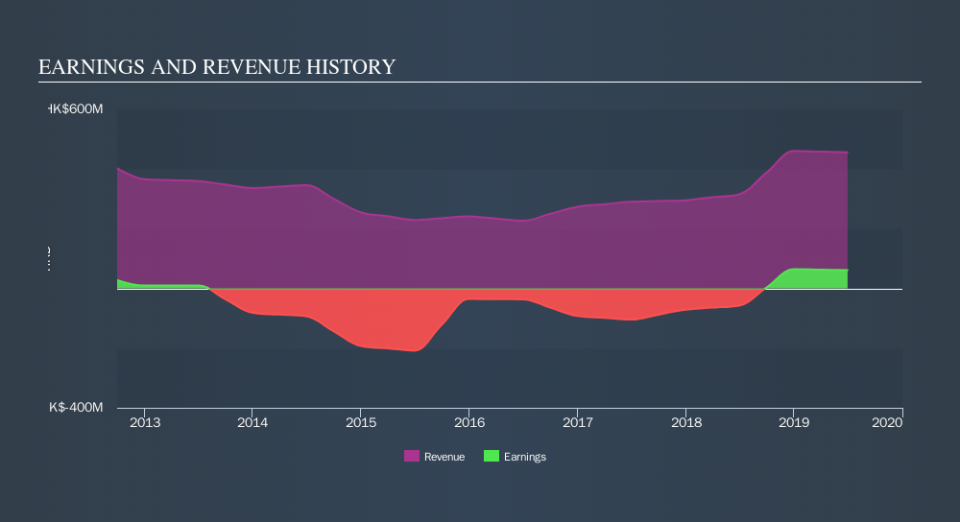

We note that, in three years, revenue has actually grown at a 24% annual rate, so that doesn't seem to be a reason to sell shares. This analysis is just perfunctory, but it might be worth researching New Silkroad Culturaltainment more closely, as sometimes stocks fall unfairly. This could present an opportunity.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While the broader market lost about 6.1% in the twelve months, New Silkroad Culturaltainment shareholders did even worse, losing 23%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 1.7%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Before deciding if you like the current share price, check how New Silkroad Culturaltainment scores on these 3 valuation metrics.

Of course New Silkroad Culturaltainment may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.