Investors Who Bought Viemed Healthcare (TSE:VMD) Shares Three Years Ago Are Now Up 308%

We think that it's fair to say that the possibility of finding fantastic multi-year winners is what motivates many investors. You won't get it right every time, but when you do, the returns can be truly splendid. Take, for example, the Viemed Healthcare, Inc. (TSE:VMD) share price, which skyrocketed 308% over three years. Also pleasing for shareholders was the 14% gain in the last three months. But this move may well have been assisted by the reasonably buoyant market (up 9.9% in 90 days).

Check out our latest analysis for Viemed Healthcare

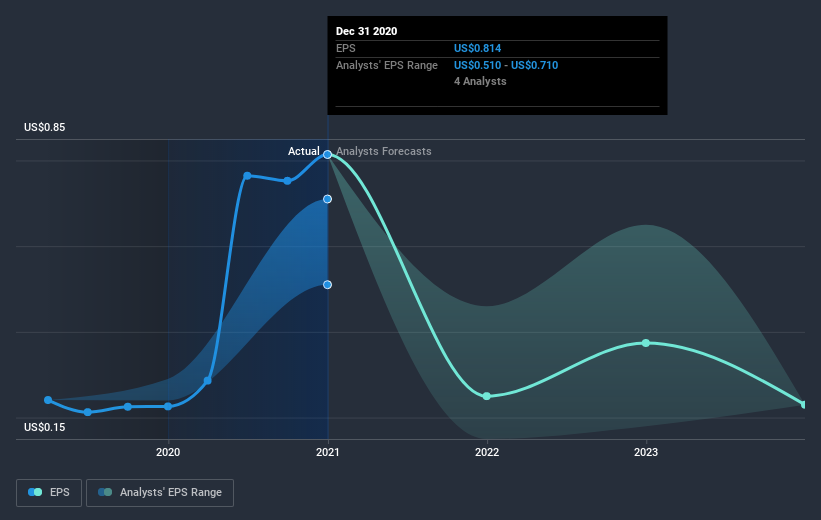

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Viemed Healthcare was able to grow its EPS at 56% per year over three years, sending the share price higher. We don't think it is entirely coincidental that the EPS growth is reasonably close to the 60% average annual increase in the share price. This observation indicates that the market's attitude to the business hasn't changed all that much. Rather, the share price has approximately tracked EPS growth.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Viemed Healthcare has improved its bottom line over the last three years, but what does the future have in store? This free interactive report on Viemed Healthcare's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that Viemed Healthcare rewarded shareholders with a total shareholder return of 231% over the last year. So this year's TSR was actually better than the three-year TSR (annualized) of 60%. These improved returns may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Viemed Healthcare (of which 1 shouldn't be ignored!) you should know about.

We will like Viemed Healthcare better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.