Investors Who Bought Wagners Holding (ASX:WGN) Shares A Year Ago Are Now Down 53%

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Taking the occasional loss comes part and parcel with investing on the stock market. And there's no doubt that Wagners Holding Company Limited (ASX:WGN) stock has had a really bad year. The share price is down a hefty 53% in that time. Wagners Holding may have better days ahead, of course; we've only looked at a one year period. The falls have accelerated recently, with the share price down 12% in the last three months.

See our latest analysis for Wagners Holding

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

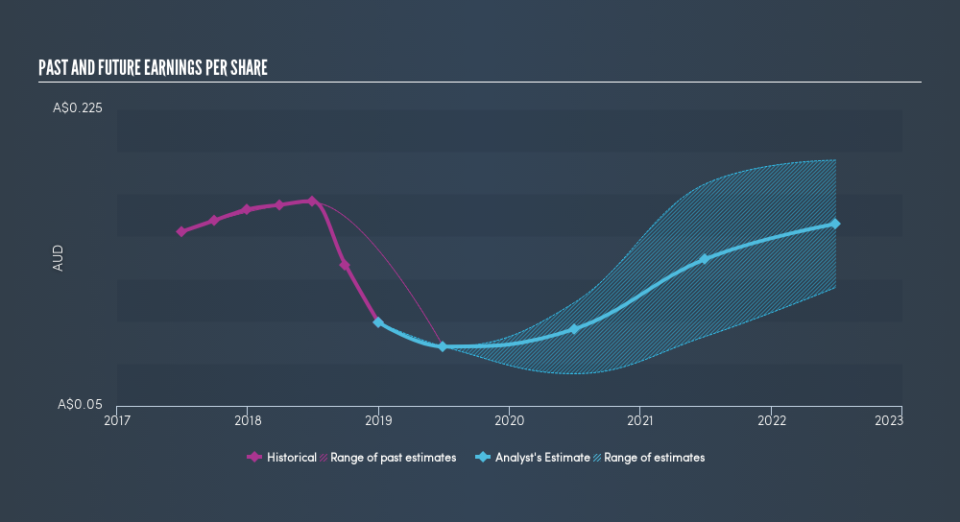

Unfortunately Wagners Holding reported an EPS drop of 40% for the last year. This reduction in EPS is not as bad as the 53% share price fall. So it seems the market was too confident about the business, a year ago.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Wagners Holding has improved its bottom line over the last three years, but what does the future have in store? Take a more thorough look at Wagners Holding's financial health with this free report on its balance sheet.

A Different Perspective

Given that the market gained 12% in the last year, Wagners Holding shareholders might be miffed that they lost 52% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The share price decline has continued throughout the most recent three months, down 12%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. Is Wagners Holding cheap compared to other companies? These 3 valuation measures might help you decide.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.