How Should Investors Feel About Freedom Holding's (NASDAQ:FRHC) CEO Remuneration?

Timur Turlov has been the CEO of Freedom Holding Corp. (NASDAQ:FRHC) since 2015, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also assess whether Freedom Holding pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

View our latest analysis for Freedom Holding

Comparing Freedom Holding Corp.'s CEO Compensation With the industry

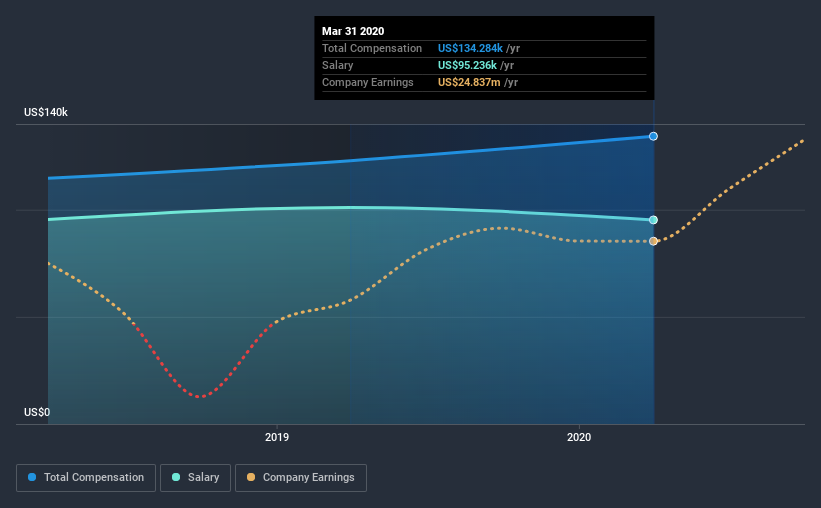

According to our data, Freedom Holding Corp. has a market capitalization of US$3.0b, and paid its CEO total annual compensation worth US$134k over the year to March 2020. That's a notable increase of 9.3% on last year. We note that the salary portion, which stands at US$95.2k constitutes the majority of total compensation received by the CEO.

On comparing similar companies from the same industry with market caps ranging from US$2.0b to US$6.4b, we found that the median CEO total compensation was US$5.4m. Accordingly, Freedom Holding pays its CEO under the industry median. What's more, Timur Turlov holds US$2.2b worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

Component | 2020 | 2019 | Proportion (2020) |

Salary | US$95k | US$101k | 71% |

Other | US$39k | US$22k | 29% |

Total Compensation | US$134k | US$123k | 100% |

Speaking on an industry level, nearly 14% of total compensation represents salary, while the remainder of 86% is other remuneration. Freedom Holding pays out 71% of remuneration in the form of a salary, significantly higher than the industry average. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Freedom Holding Corp.'s Growth

Over the last three years, Freedom Holding Corp. has shrunk its earnings per share by 31% per year. It achieved revenue growth of 68% over the last year.

The decrease in EPS could be a concern for some investors. But in contrast the revenue growth is strong, suggesting future potential for EPS growth. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Freedom Holding Corp. Been A Good Investment?

Most shareholders would probably be pleased with Freedom Holding Corp. for providing a total return of 617% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

As previously discussed, Timur is compensated less than what is normal for CEOs of companies of similar size, and which belong to the same industry. Meanwhile, shareholder returns and revenues are growing at a good clip. On the flip side, EPS growth during the same period is negative. However, considering all aspects of performance, we've concluded Timur earns an appropriate compensation.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 3 warning signs for Freedom Holding that investors should think about before committing capital to this stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.