Most investors have missed out on the stock market's epic 2019 rally

Following the market rout in the fourth quarter of 2018, the S&P 500 (^GSPC) had its best two-month start to the year since 1991. Unfortunately, data suggests that many investors have missed out on the rally.

“Equity positioning is still relatively light across discretionary and systematic portfolios (~30th percentile) while retail saw outflows until late Feb.,” JPMorgan analyst Dubravko Lakos-Bujas wrote in a note Sunday. “This implies most investors have not participated in this V-shaped recovery other than corporates and insiders who where accelerating purchases into the sell-off.”

Lakos-Bujas’ observation about corporates and insiders buying is notable in that the practice of stock buybacks has become the target of policymakers via widely read op-ed pages. In fact, some analysts argue that buybacks are among the important forces keeping stock prices up.

U.S. equity prices up, U.S. equity inflows meh

Other firms have also concluded that the investor class has missed the rally, as evidenced by a stark discrepancy between equity performance and fund flows.

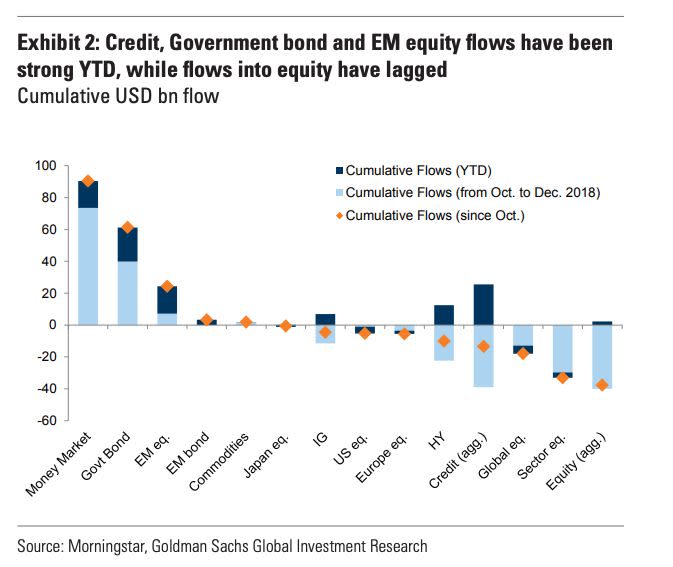

Generally, fund flows correlate with equity performance. However, inflows into equity funds have been only slightly positive for the year-to-date and not much higher than those into “safe haven” assets including government bonds, municipal bond and money market funds, Goldman Sachs analyst Alessio Rizzi wrote in a note Monday.

Based on Morningstar data, U.S.-domiciled funds and exchange-traded funds investing in both equity or credit had about $80 billion outflows from October through the end of 2018, and just $28 billion inflows for the year-to-date, with flows becoming relatively more risk-on just last week. Less risky government bonds and money market funds flows have continued to be positive, up $113 billon from October through December and up by about $37 billion in 2019 so far.

“The equity rally at the start of 2018 was backed by strong inflows; this is not the case so far in 2019,” Barclays equity strategist Emmanuel Cau wrote in a note Thursday. “The latest CFTC data show that asset managers have increased their long SPX exposure back to the level prior to the December de-risking. However, they are still well off the Q1 2018 highs.”

While U.S. equity funds inflows have only trickled so far this year, fund flows for other risky assets including credit and emerging market equities have been stronger, Rizzi noted. Cau wrote in a note Thursday that dedicated emerging market equity funds have seen almost 18 consecutive weeks of inflows since October.

—

Emily McCormick is a reporter for Yahoo Finance. Follow her on Twitter: @emily_mcck

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, andreddit.

Read more from Emily:

What Wall Street strategists forecast for the S&P 500 in 2019

Beer sales are lukewarm and pot could be part of the problem

Consumer sentiment plunges to its lowest level since Trump’s election