Is Invibes Advertising (EPA:ALINV) A Risky Investment?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Invibes Advertising SA (EPA:ALINV) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Invibes Advertising

What Is Invibes Advertising's Debt?

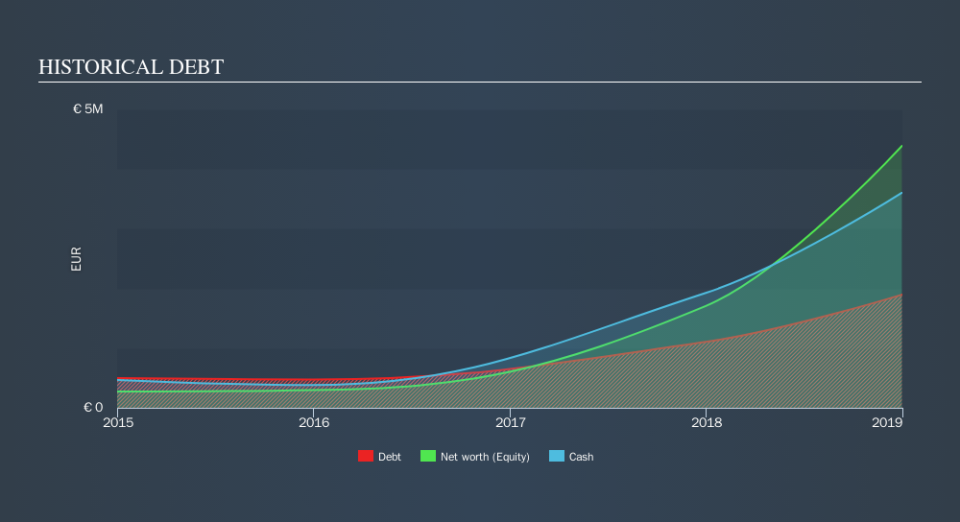

The image below, which you can click on for greater detail, shows that at December 2018 Invibes Advertising had debt of €1.90m, up from €1.11m in one year. However, it does have €3.60m in cash offsetting this, leading to net cash of €1.71m.

A Look At Invibes Advertising's Liabilities

We can see from the most recent balance sheet that Invibes Advertising had liabilities of €3.50m falling due within a year, and liabilities of €1.18m due beyond that. Offsetting this, it had €3.60m in cash and €1.98m in receivables that were due within 12 months. So it actually has €904.0k more liquid assets than total liabilities.

This surplus suggests that Invibes Advertising has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Simply put, the fact that Invibes Advertising has more cash than debt is arguably a good indication that it can manage its debt safely. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Invibes Advertising's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Invibes Advertising managed to grow its revenue by 57%, to €6.1m. With any luck the company will be able to grow its way to profitability.

So How Risky Is Invibes Advertising?

Although Invibes Advertising had negative earnings before interest and tax (EBIT) over the last twelve months, it made a statutory profit of €672k. So when you consider it has net cash, along with the statutory profit, the stock probably isn't as risky as it might seem, at least in the short term. We think its revenue growth of 57% is a good sign. There's no doubt fast top line growth can cure all manner of ills, for a stock. When we look at a riskier company, we like to check how their profits (or losses) are trending over time. Today, we're providing readers this interactive graph showing how Invibes Advertising's profit, revenue, and operating cashflow have changed over the last few years.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.