iPhones, iPhones, iPhones — What you need to know in markets on Tuesday

Tuesday is the day.

At 1 p.m. ET on Tuesday, Apple (AAPL) will kick off the keynote address at its much-anticipated developers conference at which it is expected to announce a new line of iPhones, including the device’s first major overhaul in a few years.

Reports out over the weekend indicated that Apple will announce three new models — iPhone X, iPhone 8, and iPhone 8 plus.

The company’s highest-end model is expected to have an edge-to-edge display, will unlock by reading your face (rather than your thumb), and will have (semi) wireless charging. Yahoo Finance’s Dan Howley has everything we’re looking for on Tuesday, and the Yahoo Finance team will of course have wall-to-wall coverage throughout the day.

It’s worth noting that so far this year, Apple shares are up about 40% as investors in part anticipated this newest iPhone, which analysts have said should usher in an upgrade “supercycle.”

But over the last five years, Apple shares have had a nice, but not tremendous run, with a 65% gain and a couple of 20%+ slides mixed in.

And when you compare this to its most commonly-compared tech peers — the FAAMNG stocks — Apple’s returns are downright meager. Over the last five years Facebook (FB) is up over 800%, Netflix (NFLX) has gained a gaudy 2000%, while Amazon (AMZN), Microsoft (MSFT) and Google (GOOGL) have all seen their share prices double.

This year, only Facebook and Netflix are outpacing Apple, and given this stronger performance relative to its peers, it is fair to say expectations from an investor standpoint are fairly high ahead of Tuesday’s event. The old market adage says that you buy the rumor but sell the news. Well, Tuesday is the news, so we’ll see what happens then.

Elsewhere in markets on Tuesday, investors will get a couple of pieces of economic data in the morning with the NFIB’s latest reading on small business optimism and the latest job openings and labor turnover survey, or JOLTS report.

Markets will also look to build on a strong opening day to the trading week which saw each of the major averages rise 1% with the Dow moving back above 22,000 and the S&P 500 hitting a new record high.

This bounce was led by insurers, which rallied as estimated losses for Hurricane Irma appeared to be below expectations. We’d note that shares of Equifax (EFX), were down another 8% on Monday, bringing the stock’s losses to 20% since last Thursday’s reveal that the information of some 143 million U.S. customers may have been revealed.

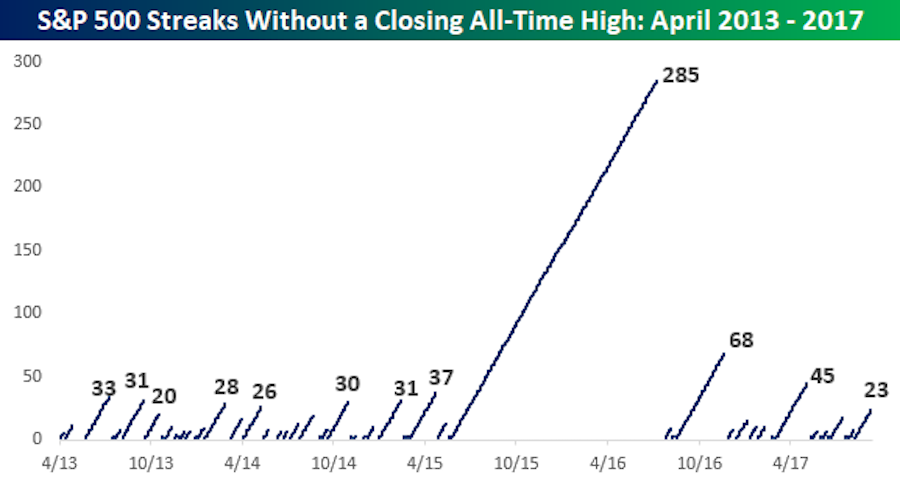

Bespoke Investment Group noted on Monday that the new high for the S&P 500 snapped a 23-day streak of no new records for the benchmark index, a stretch that perhaps felt interminable for some investors but was nothing like the 285-day streak of no new records we saw from 2015 into the middle of last year.

Yahoo Finance’s Sam Ro noted Monday that Goldman Sachs’ (GS) clients can’t stop asking about when a market correction will be upon us, with investors often citing the current length of the bull run as an argument against any future success. But the holding pattern we saw markets locked in for almost a full year is a reminder that it hasn’t all been up and to the right for stocks in the last eight years.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: