Iridium (IRDM) to Report Q1 Earnings: What's in the Offing?

Iridium Communications IRDM is slated to release first-quarter 2023 results on Apr 20, before market open.

The Zacks Consensus Estimate is pegged at a loss of 2 cents, unchanged in the past 30 days. In the year-ago quarter, the company reported earnings of 2 cents per share.

The consensus estimate for revenues is pegged at $186.7 million, suggesting year-over-year growth of 11%

Over the trailing four quarters, the company has an average surprise of 150%.

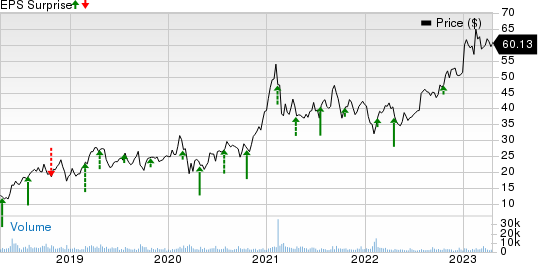

Iridium Communications Inc Price and EPS Surprise

Iridium Communications Inc price-eps-surprise | Iridium Communications Inc Quote

Factors at Play

Iridium is likely to have benefited from momentum in Services, and Engineering and Support Service business segments. Engineering and Support Service is gaining from increased activity with the U.S. government.

The company’s commercial service revenues are likely to have benefited from growth in IoT, ongoing activations and solid uptake of its broadband services.

Iridium’s cost-effective broadband services, provided through Certus technology, and increasing penetration of its L-band services bode well. The voice and data business is likely to have benefited from increasing demand for newer services like Push-to-Talk and Iridium GO! Services. The company's collaboration with Qualcomm for satellite messaging and emergency services in smartphones is an additional tailwind.

IRDM’s recurring service revenue base, driven by robust subscriber growth and mobile penetration, lends it a competitive edge and is anticipated to have driven its first-quarter performance. As of Dec 31, 2022, the company had 1,999,000 billable subscribers, up 16% compared with 1,723,000 at the end of the prior-year quarter. The year-over-year increase was backed by strength in commercial IoT.

The Zacks Consensus Estimate for quarterly revenues from Services (which accounts for a significant chunk of total revenues) is pegged at $138 million, indicating a rise of 9.5% from the year-ago quarter’s levels.

The Zacks Consensus Estimate for quarterly revenues from Subscriber Equipment is pegged at $32.56 million, indicating a decrease of 3.5% year over year. The Zacks Consensus Estimate for revenues from the Engineering and Support Service segment is pegged at $15.63 million, up 87% from the prior-year quarter’s levels.

However, global macroeconomic weakness, inflation and supply-chain disruptions (although somewhat easing) are likely to have acted as headwinds for Iridium’s first-quarter revenues. Further, surging operating expenses and increased lead time to obtain spectrum licenses are likely to have weighed on the company’s margins to some extent.

What Our Model Says?

Our proven model does not conclusively predict an earnings beat for Iridium this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. However, this is not the case here.

Earnings ESP: Iridium has an Earnings ESP of -233.33%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Iridium carries a Zacks Rank #2 currently.

Stocks With Favorable Combination

Here are some stocks you may consider as our model shows that these have the right combination of elements to beat on earnings this season.

Meta Platforms META has an Earnings ESP of +8.00% and currently flaunts a Zacks Rank of 1. META is set to announce quarterly figures on Apr 26. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Meta’s to-be-reported quarter’s earnings and revenues is pegged at $1.97 per share and $27.49 billion, respectively. Shares of META are up 0.7% in the past year.

Spotify Technology SPOT has an Earnings ESP of +25.96% and presently carries a Zacks Rank #2. SPOT is slated to release quarterly numbers on Apr 25.

The Zacks Consensus Estimate is pegged at a loss of $1.04 per share and $3.36 billion for revenues, respectively. Shares of SPOT are down 2.6% in the past year.

Kimberly-Clark Corporation KMB has an Earnings ESP of +6.71% and currently has a Zacks Rank #2. KMB is scheduled to report quarterly earnings on Apr 25.

The Zacks Consensus Estimate for KMB’s to-be-reported quarter’s earnings and revenues is pegged at $1.31 per share and $5.08 billion, respectively. Shares of KMB are up 9.3% in the past year.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Kimberly-Clark Corporation (KMB) : Free Stock Analysis Report

Iridium Communications Inc (IRDM) : Free Stock Analysis Report

Spotify Technology (SPOT) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report