IRobot: Excellent Fundamentals and a 24% Margin of Safety

The iRobot Corp. (NASDAQ:IRBT) made a name for itself in the early and mid-2000s with a consumer product we had never seen before: a robotic vacuum cleaner. It fit an obvious need in the marketplace, vacuuming hard-surface floors without effort.

Or did it? I remember many hours spent getting the two Roombas I owned maintained and operating. But, then again, I also wasted a lot of time watching the machine make seemingly random trips around the rooms and eventually vacuuming the whole floor (remember the sugar test?)

Since those early days, iRobot has sold 30 million Roombas and grown to become a small-cap corporation.

Its success has also generated competition, and therein lies a tale. IRobot got caught up in the import tariffs imposed on products from China last year, tariffs that had the effect of pushing up its costs. It tried to pass those increases along to customers, but customers weren't having it. They switched to other brands.

The company regained some market share when it rolled back its prices to pre-tariff levels. In April, it received some relief when the U.S. Trade Representative gave it a temporary exemption from the tariffs. And, on Aug. 7, it will find out if that exemption will be extended; that's obviously a very important decision.

All of that is also responsible for a major selloff of its stock in 2019, before making a partial recovery this year:

We ask, then, if this is still a company worth consideration, especially if we a have holding horizon of at least five years.

For starters, it is a Buffett-Munger Screener stock. Since it made it through this screener, it should be a wonderful company at a fair price, the sort of stock that Warren Buffett (Trades, Portfolio) and Charlie Munger (Trades, Portfolio) might buy for Berkshire Hathaway (NYSE:BRK.A)(NYSE:BRK.B) if they bought small caps.

It also boasts excellent ratings for financial strength and profitability, so we can assume it is well managed, and good managers should be able to guide it through this tariff difficulty and take it profitably into the future.

Financial strength

The usual culprit for a less-than-perfect rating is debt, particularly long-term debt. However, as this GuruFocus graphic illustrates, debt is not an issue:

The Piotroski F-Score helps us zero in on the weak spots in iRobot's financial condition. It has a score of only 6 because it failed on three of the tests: changes in return on assets, changes in the gross margin and changes in asset turnover. Needless to say, these three changes were negative.

Further down the table, we see the weighted average cost of capital is higher than the return on invested capital--a bad sign indicating the company needs debt or curtailment of some operations to provide operating capital. In this case, the ROIC is 7.08% versus the WACC of 12.54%.

These are the reasons why iRobot did not receive a perfect rating, but we will remember that 8 out of 10 is still a very good score.

Profitability

Both the operating and net margins are in the high single-digits, which is acceptable. Over the past 10 years, the median operating margin was 8.53%, so the current margin of 9.18% is better than average. Presumably, if iRobot can escape the tariff problem, its margins could go up again.

Proactively, it is moving some of its manufacturing to Malaysia in a bid to get around the tariffs on Chinese-manufactured products. In its 10-K for 2019, it reported: "Commenced Roomba production in Malaysia in late 2019, which was ahead of schedule, and balanced production across multiple manufactures in China."

Both return on equity and return on assets are strong, in the double-digits.

But we really begin to see the strength of the company's growth and profitability by looking at the last three lines in the table:

Three-year revenue growth rate: 21.9%

Three-year Ebitda growth rate: 19.6%

Three-year earnings per share without non-recurring items growth rate: 26.1%.

Despite a bad year last year, over the past three years it has notched excellent growth rates for revenue and two measures of earnings. Results such of these can drive capital gains, assuming the company can shelter itself from other headwinds (such as tariffs).

Valuation

This middling score indicates that iRobot is no bargain, but probably not too overpriced either. We'll check that by looking in detail at a couple of pricing metrics.

First, the price-earnings ratio of 21.36 is reasonable for a pseudo-tech company (over the past three years, its research and development budget has been a point or two over 10%).

According to the green bar under the history column, it is currently trading for less than it has in the past. The median price-earnings ratio over the past decade is 29.91, making the current ratio look more like a bargain.

The hardware industry median is 20.91, so iRobot is competitive on that front, as suggested by the yellow bar.

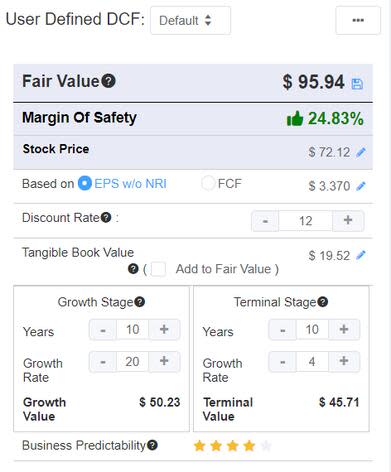

Turning to the other metric, discounted cash flow, we're in for a surprise if we based our expectations on the valuation rating. The company is significantly undervalued, according to the DCF calculator:

Share buybacks

IRobot does not pay a dividend, meaning it continues to put its free cash flow into development and growth

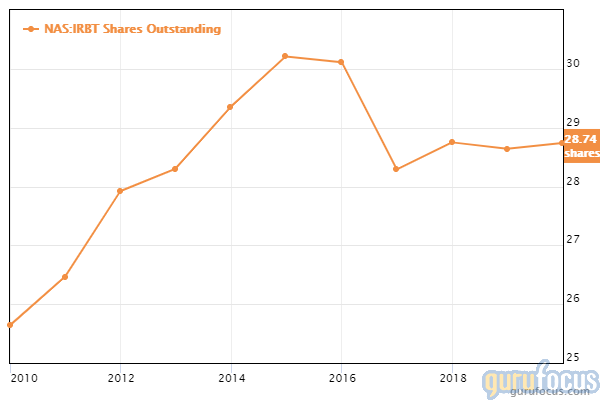

Nor has it repurchased its own shares in the recent past:

That's consistent with a company that aims to keep growing. The strategy for growth includes further development and sales of the Braava family of robot mops and Terra t7 robot lawnmowers.

Gurus

Although iRobot is a small-cap company, there is serious interest among the gurus, with eight of them holding positions at the end of the first quarter.

PRIMECAP Management (Trades, Portfolio) is the most committed to iRobot with 3,783,650 shares, representing 13.57% of the company's outstanding shares (after a reduction of 5.12% in the first quarter).

Lee Ainslie (Trades, Portfolio) of Maverick Capital held 178,045 shares, and was also committed, in his own way; he increased his holding by 200.42% in the quarter. Hotchkis & Wiley held 73,440 shares.

Conclusion

With excellent ratings for financial strength and profitability, as well as a margin of safety of nearly 25%, iRobot looks like a Buffett-Munger Screener company, a wonderful company at a fair price.

Its current share price reflects its current difficulty and uncertainty with tariffs, but once those are resolved, the company may provide strong capital gains.

Thus, iRobot may be suitable for value investors looking for growth, but not for income investors because there is no dividend now and no sign of one ahead.

Disclosure: I do not own shares in any companies named in this article.

Read more here:

Jim Simons' Firm Loaded Up on Extra Space Storage

Strength in Diversity for Texas Instruments

T Rowe Price: A Dividend Aristocrat on Sale

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.