Some Ironwood Pharmaceuticals (NASDAQ:IRWD) Shareholders Are Down 21%

While not a mind-blowing move, it is good to see that the Ironwood Pharmaceuticals, Inc. (NASDAQ:IRWD) share price has gained 28% in the last three months. But that doesn't change the fact that the returns over the last three years have been less than pleasing. Truth be told the share price declined 21% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

See our latest analysis for Ironwood Pharmaceuticals

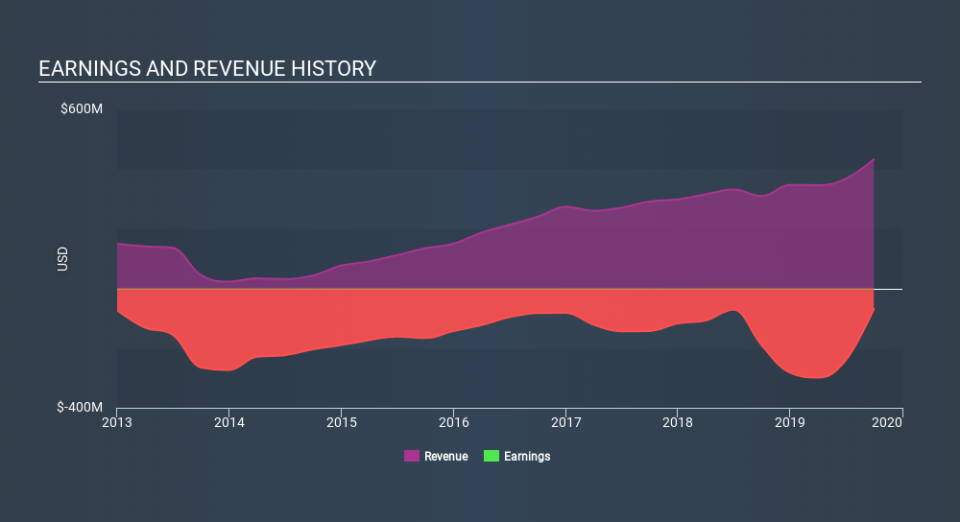

Ironwood Pharmaceuticals isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years, Ironwood Pharmaceuticals saw its revenue grow by 16% per year, compound. That's a fairly respectable growth rate. Shareholders have endured a share price decline of 7.4% per year. This implies the market had higher expectations of Ironwood Pharmaceuticals. With revenue growing at a solid clip, now might be the time to focus on the possibility that it will have a brighter future.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling Ironwood Pharmaceuticals stock, you should check out this FREE detailed report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Ironwood Pharmaceuticals's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. We note that Ironwood Pharmaceuticals's TSR, at -7.7% is higher than its share price return of -21%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

Ironwood Pharmaceuticals shareholders gained a total return of 18% during the year. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it's actually better than the average return of 0.7% over half a decade This could indicate that the company is winning over new investors, as it pursues its strategy. If you would like to research Ironwood Pharmaceuticals in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.